The Emergence of NFT-Fi

Opportunities & gems.

Hey, friend!

It’s the 14th edition of Gems Corner. Today’s edition highlights the re-emergence of NFT Finance, BRC-20 tokens, and other alpha.

Enjoy the gems.

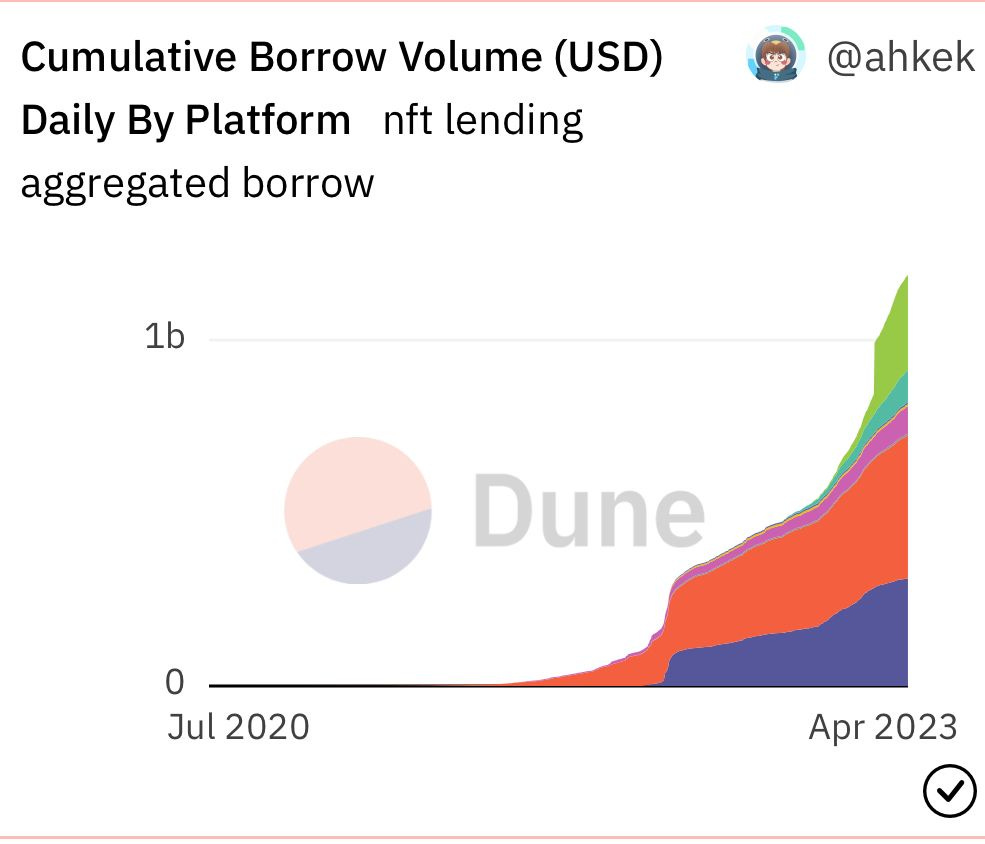

Borrowing against NFTs recently surpassed an ATH of $1 billion. If you ain't been paying attention to NFT Finance, now it's the best time.

As the name implies, NFT Finance is literally the fusion of NFTs and DeFi. It's an attempt to unlock more use cases on NFTs beyond the usual trading as we know it.

With NFTFi, users can lend, borrow, rent, and hedge their NFTs unlocking greater utility and yields.

To better understand NFT lending, let's analyze the two primary types of lending protocols:

a) Peer-to-Peer

b) Peer-to-Pool

a) Peer-to-Peer (P2P): Lending Protocols Here, the platform provides the infra that connects prospective lenders and borrowers but is not directly involved. If you use CEXs, you'll be familiar with this model.

b) Peer-to-Pool Lending Protocols: In peer-to-pool lending platforms, lenders fund a pool, and the funds are lent out to interested borrowers against collateral at a % interest rate. Similar to Aave's pool model.

It would interest you to know that NFT lending platforms offer more attractive yields than Aave & Lido.

So, who are the key players in the NFT finance space?

There are a couple of interesting projects pushing the boundaries of NFTs, but for the sake of this thread, we'll look at 5 players.

ParaSpace

BendDAO

JPEG'd

NFTfi

Blend (by Blur)

1. ParaSpace / @ParaSpace_NFT

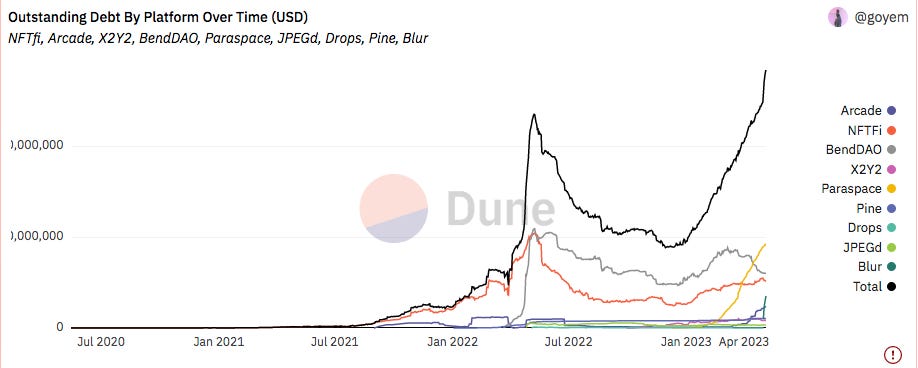

Currently the largest NFT lending protocol by TVL, ParaSpace allows users to lend and borrow against fungible & non-fungible tokens. Also, users can access immediate liquidity by collateralizing and borrowing against their NFTs.

2. BendDAO / @BendDAO

BendDAO is frontrunning the peer-to-pool NFTFi narrative and has seen phenomenal growth since its mainnet launch in 2022. Essentially, they allow users to borrow against blue-chip NFT instantly.

3. JPEG'd / @JPEGd_69

JPEG'd enable users to leverage their NFTs and unlock liquidity without ever selling. They're one of the biggest $CVX holders, enabling them to wield governance rights and get juicy yields.

4. NFTfi / @NFTfi

They're a peer-to-peer NFT lending protocol that facilitates NFT trades. With NFTfi, users can list their NFTs and start getting loan offers. Recently, they launched an incentivized lending program to reward users with points.

5. Blend - @blur_io

Blend is the latest entrant to the NFTFi party, and like always, they came prepared. The platform has two primary products: NFT collateralized lending and "buy now, paylater". A few days after launch, they've already processed about 39K ETH in loans.

Worthy Mention:

Tribe3, an NFT Futures & Prep DEX, recently raised $2.1M, led by Spartan Group. Plus, several other NFTFi platforms hitting ATHs recently.

It is clear that the NFTFi narrative is quickly picking up steam and might see phenomenal growth in the remaining parts of 2023.

Research by Electric Capital reveals that 80% of new wallets' first transaction in 2022 was related to NFTs.

NFTFi is coming, anon.

Image of the Day

Interacting with these projects will increase your chances of getting an Airdrop, and there are lots of airdrop threads scattered on Twitter on them. Go, interact, anon.

Alpha Drips

China's national blockchain research center aims to train at least 500,000 blockchain professionals - link

If you have minted NFTs on Ethereum or used mint.fun, a free mint - link

Metamask now enables users to buy ETH using PayPal - link

Beginner’s guide on getting started in the Bitcoin ecosystem - link

Jaredfromsubway.eth’s MEV bot rakes about $3.5M in three months - link

Tether records a $1.48 Billion Net Profit on its Q1 2023 Attestation Report - link

Thanks for reading!

Until next Friday,

Viktor DeFi.