Ethereum ETF Goes Crazy

ETF re-awakens the market

The 24th edition of Gems Corner focuses on the recent Ethereum ETF frenzy, together with some other alpha drops on VC landscape and MVX. Enjoy the gems.

This week the market was re-awakened by the news of some recent Ethereum ETF filings by leading asset management funds.

Before we proceed, If you’d recall a few months ago, BlackRock, Fidelity & a few other firms filed for spot bitcoin ETF - Which I discussed the implications in my previous edition.

A few sources have already confirmed (see the attached image) the likelihood of those filings being approved earlier than anticipated. Yeah, you heard right.

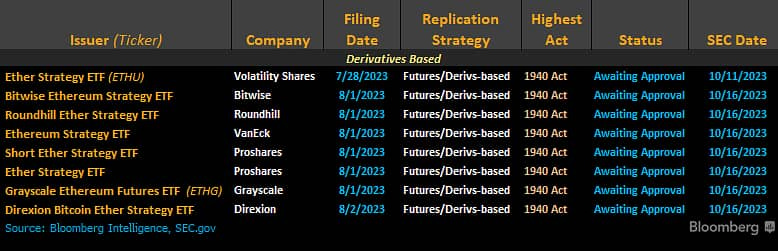

Moving forward, 10 filings have been made recently for Ethereum futures ETF. The filings are from the following organizations: Bitwise, Proshares, Direxion, Roundhill, VanEck, Grayscale, and Volatility Shares.

Basically, these ETFs would grant investors exposure to the futures contract of Ether currently traded on the CFTC-regulated Chicago Mercantile Exchange (CME), instead of holding the token.

There was a “good case” for the SEC to approve the ether futures ETFs for the same reasons that they approved the bitcoin futures ETFs in the first place. - Matt Apkarian.

It is worth noting that the SEC has previously approved ETFs that invest in bitcoin futures in the past, the pending bitcoin filings are for spot ETFs.

The key difference between spot and futures ETF is that while spot ETF enables investors to buy the underlying asset without actually purchasing the currency, futures ETF provide traders with accessibility to futures contracts rather than security.

Even though Ethereum Futures ETF wouldn’t make much to the market as spot ETFs, I think it’s a great start for the world’s second-largest cryptocurrency. It will also herald a new narrative in the coming weeks as illustrated by Pentoshi.

The institutions are coming. Mass adoption is beckoning. The stage is getting ready.

July VC Update

It is no news that the crypto VC landscape has maintained a sharp decline for the last couple of months. In light of the decline in overall funding, some aspects of crypto have seen a steady increase in funding.

As seen in the attached image, the infrastructure category continues to receive the most notable funding from VCs. Flashbots, RISC Zero, HI, Cosmic Wire, Manta Network and Cymbal are among the top projects with fat seed rounds.

To stay up to date on VC Investments, you can either use Rootdata or DeFiLlama.

Image of the Day

The attached image is originally from a book called “Benners Prophecies: Future Ups And Down In Prices" by Samuel Benner.

I shared it because I believe his predictions resonate with the current market landscape. Looking closely at the image, you’ll discover that the year 2023 falls under the years of hard times, low prices, and a good time to buy stocks and hold till the boom comes.

As much as Benner’s Cycle has been claimed to accurately predict the market cycle for over 100 years, it does not rule the place for changes due to external market forces like political and climatic.

But generally, it gives a clue of the current market sentiments and what to expect onwards.

The $MVX TOKEN

I think $MVX, the native token of Metavault Trade is underrated.

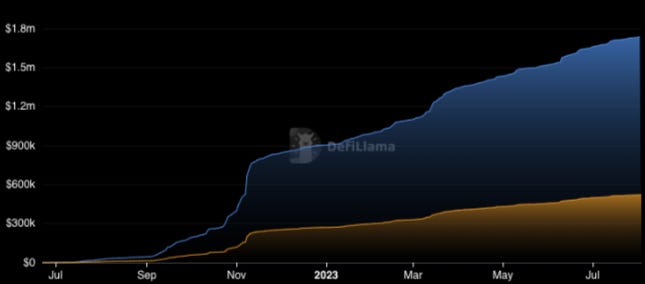

The above chart indicates an increasing trajectory in the fees and revenue generated by Metavault - a percentage of which goes to $MVX stakers. Here’s the breakdown of the benefits that $MVX stakers enjoy:

30% of fees generated by Metavault Trade

50% of fees generated by its Binary Options Platform

50% of fees generated by 0xBets, its GambleFi project

12.5% share of GrizzlyTrade PerpDEX fees

and 7% of QuickPerp Fees.

Disclosure: I have some MVX in my bag, always DYOR

Actionable Strikes

Sign up for Early Access to Nansen 2 - link

Sign up for Early Access to Velo Data (Possible Airdrop) - link

Sign up for Early Access to Infinex (Possible Airdrop) - link

Week 2 of the Polygon zkEVM Saga is up - link

DerpDEX Genesis Airdrop Campaign is Live - link

Thanks for reading!

Until next Friday,

Viktor DeFi.

PS: I’d love to hear your feedback and comments.