Institutions takes the front seat

Blackrock, et al. takes a bold move

Hey, friend!

It’s the 19th edition of Gems Corner. Today, we’ll examine Bitcoin ETFs and the institutions taking a bold leap into crypto.

Enjoy the gems.

Maybe you’ve heard about Bitcoins ETFs on Twitter or TV and wondering what it really means. Well, I’ll break it down here for you.

First, ETF is an acronym for exchange-traded funds. Bitcoin ETFs expose retail investors to Bitcoin without owning or trading it. It's mainly offered on traditional exchanges by brokerages.

However, since TradFi is highly regulated, institutions that want to start trading Bitcoin ETFs must get a license from the relevant regulatory authorities. The United States has yet to approve spot Bitcoin ETF - backed by Bitcoin.

Over the past two weeks, we have seen an influx of Bitcoin ETF filings from the world’s largest asset management firms like Blackrock, WisdomTree, Invesco, and Valkyrie.

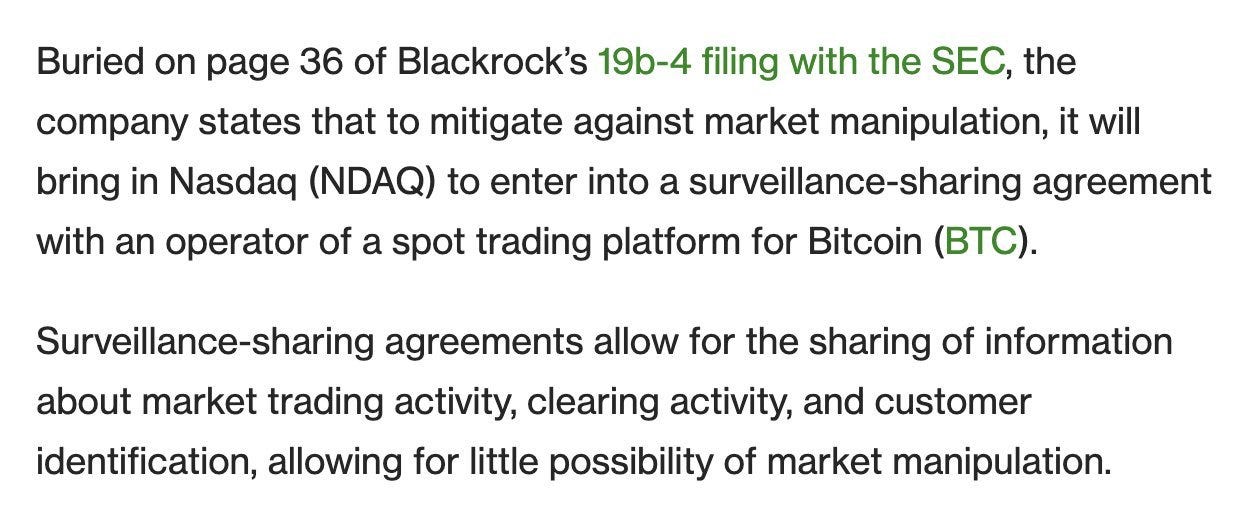

The exciting thing about Blackrock's filling is that they'll partner with Nasdaq in a surveillance-sharing agreement to mitigate manipulation. Looks cool to me.

Although the fillings look coordinated as it's coming immediately after SEC recently sued Binance and Coinbase. Seems like the TradFi dudes want a pie of crypto fees after all, even though they've been criticizing it for a while.

But on the bright side, it means massive Bitcoin/crypto adoption. Once approved, Blackrock & the others will educate millions of retail consumers on allocating a portion of their portfolio to crypto. This will increase consumer interest in other crypto products.

Apart from that, I think it's gonna trigger the next cycle faster than we think. BTC's price action will reflect this in the days and months to come.

Winter is here, fren; Bitcoin ETF is a huge catalyst for the bull run.

Chart of the Week

BTC broke $30k this week, restoring retail investors’ hope in the market while signaling light at the end of the tunnel. Would it be ‘up only’ onwards? Time will tell.

Actionable Strikes

Participate in HMX’s public open beta for Airdrop - link

4 Arbitrage strategies you can try out today - link

Free NFT Mint by Zora - link

Project Updates, News & Gems

Zora launches L2 NFT Network - link

BNBChain announced opBNB, an L2 solution - link

EDX Markets, a new exchange backed by Fidelity, Citadel & Schwab, kicks operations - link

Binance Labs Invests in Five Incubation Projects - link

The number of staked ETH exceeds 20 million - link

Vela Exchange launches officially on 26th July - link

Etherfi opens Validator Staking Program to all users - link

Chronos Finance launches NFT Marketplace - link

Thanks for reading!

Until next Friday,

Viktor DeFi.

PS: I’d love to hear your feedback and comments.