Win with these tools

Top crypto tools to help you win!

It’s the 75th edition of the Gems Corner and today we will be looking at some under-the-radar tools that will give you an edge in the market.

To win in crypto, you need to have an edge. And, using the right tools is the easiest way to have such an edge in the market.

Not every information is posted on X (Twitter), and not all can be googled. If all you do is rely on these platforms, you’ll get the same results as everyone else. Today, I’ll be listing some of the tools I use to get ahead of the market, in no particular order.

"The single greatest edge an investor can have is a long-term orientation" - Seth Klarman

1. DeFiLlama

It’s a one-stop app for everything defI. With its comprehensive suite of tools, it provides real-time insights into total value locked (TVL), liquidity trends, yield farming opportunities, and protocol performance across multiple blockchains. Very useful.

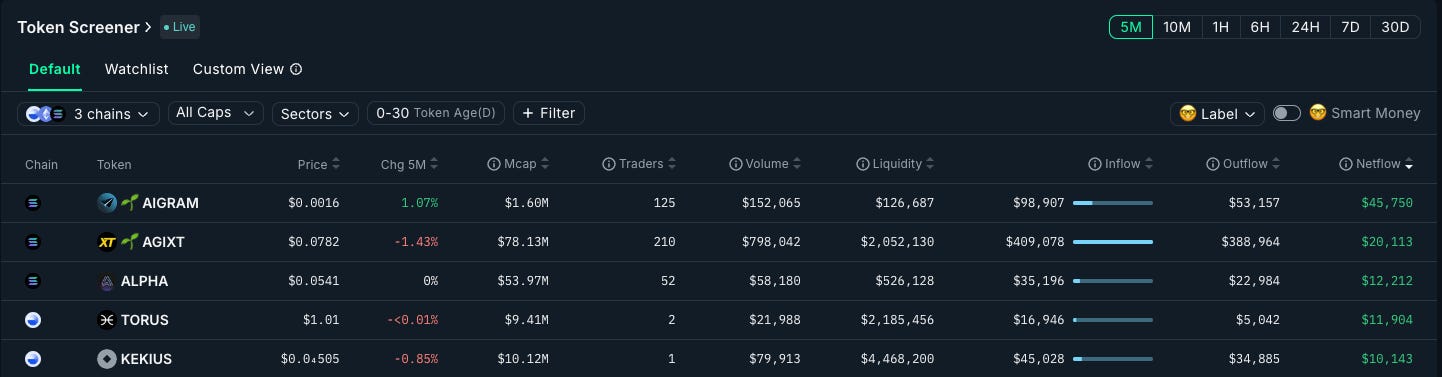

2. CryptoRank

With real-time data, in-depth market analysis, and comprehensive rankings, CryptoRank empowers investors, traders, and enthusiasts to make informed decisions. I particularly use it for tracking IDOs (past and present) and funding rounds.

3. Nansen

By leveraging advanced data analytics and AI, Nansen helps users track wallet movements, identify key trends, and discover opportunities in the crypto market. You can uncover profitable wallets on-chain and copy-trade them leveraging Nansen. It’s a cheat code for smart trading.

Nansen is a paid tool: It’s worth the investment if you have but if you don’t, there are other free tracking tools like Arkham and Cielo Finance.

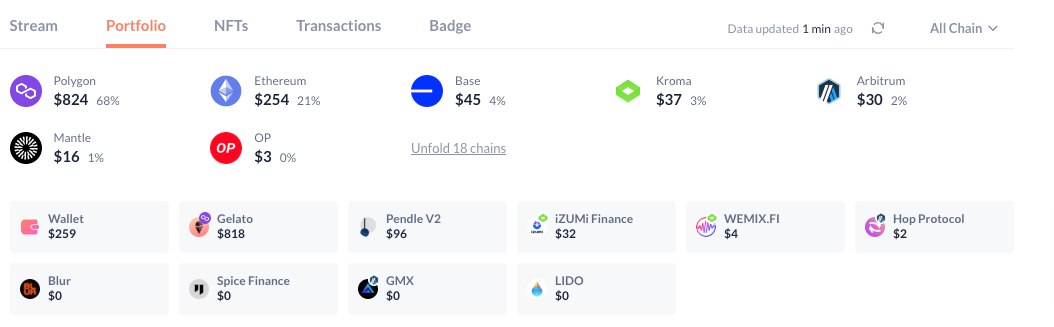

4. DeBank

DeBank is a portfolio management tool for managing your assets across various blockchains. You can also use it to check your PnL, transactions and track other wallets as well. Since DeBank is mainly for EVM blockchains, you can use Step Finance to track your assets on Solana.

If you don’t have the time to enter into the trenches with these tools, you can subscribe to top-tier crypto research firms like Delphi Digital and Messari for unfiltered alphas. They do all the digging for you and give you the data to make informed decisions.

Other honorable mentions:

RWA(xyz): for tokenized RWA insights

SoSoValue: for tracking ETFs inflows and outflows

Dune and Flipside Crypto: for blockchain dashboard and analytics

Tweet of the day

The coming months will be surreal - lock in.

Alpha Bites and Tweets

Check your airdrop allocation for Orbiter Finance - link

Check your airdrop allocation for Jup - link

Check your airdrop allocation for Solv - link

Sign up for early access on Monsters(fun) - link

That’s a wrap.

Thanks for reading!

Till next Friday,

Viktor DeFi.

PS: I’d love to hear your feedback and comments.