Trump backs crypto

The orange coin gets recognition

It’s the 78th edition of the Gems Corner and today we will be looking at the rising robotics narrative, plus other alphas.

The financial landscape has shifted once again. In a historic move, President Donald J. Trump has signed an Executive Order establishing the U.S. Strategic Bitcoin Reserve, marking the first time Bitcoin is officially recognized as a strategic asset within the U.S. government’s holdings. This decision could redefine America’s financial and geopolitical positioning in the years to come.

Key Takeaways from the Executive Order:

A Digital Fort Knox: The U.S. government will hold and maintain Bitcoin as a strategic reserve asset, much like gold, treating it as a store of value.

No Immediate Taxpayer Purchases: The reserve will start with Bitcoin already in federal custody, primarily coins seized through law enforcement actions. No new taxpayer funds will be allocated for Bitcoin acquisitions at this time.

No Selling, Only Holding: All Bitcoin in the reserve will be held indefinitely—the government will not liquidate these holdings, reinforcing Bitcoin’s legitimacy as a long-term asset.

A Broader Digital Asset Strategy: The order also establishes a U.S. Digital Asset Stockpile for other cryptocurrencies seized in legal actions, but only Bitcoin will be treated as a strategic reserve.

Economic and National Security Implications: This move aims to protect national financial interests, hedge against monetary shifts, and keep the U.S. competitive in a world where digital assets are increasingly playing a critical role.

Why This Matters

For years, Bitcoin advocates have argued that the world’s first decentralized currency is the digital equivalent of gold. This Executive Order is a monumental step toward institutional recognition of that argument. By locking Bitcoin into national reserves, the U.S. signals confidence in its long-term value while preventing past mistakes—where seized Bitcoin was auctioned off at a fraction of its future worth.

This move also comes as global financial systems undergo major shifts. With countries like El Salvador adopting Bitcoin as legal tender and central banks exploring digital currencies, the U.S. is making a strategic play to cement its dominance and become the Crypto Capital of the world.

Market & Political Reactions

Reactions to the announcement have been swift and varied:

Bitcoin’s Price: Initial market reactions were mixed, with short-term volatility, but many believe this move will ultimately be bullish for Bitcoin’s long-term price stability and institutional adoption.

Crypto Advocates Applaud: Pro-crypto lawmakers like Senator Cynthia Lummis praised the order as a “pioneering move” that strengthens U.S. financial sovereignty.

Critics Express Concerns: Some policymakers warn that the government’s involvement in crypto markets could lead to increased regulation, while others argue that Bitcoin’s volatility makes it a risky reserve asset.

What Comes Next?

The establishment of a Strategic Bitcoin Reserve raises several key questions:

Will the government expand its Bitcoin holdings in the future beyond seized assets?

Could this pave the way for state or federal pension funds to allocate Bitcoin in their portfolios?

Will other nations follow suit, accelerating Bitcoin’s adoption as a global reserve asset?

What’s clear is that Bitcoin is no longer just a niche asset—it is now a recognized part of the United States’ strategic financial future.

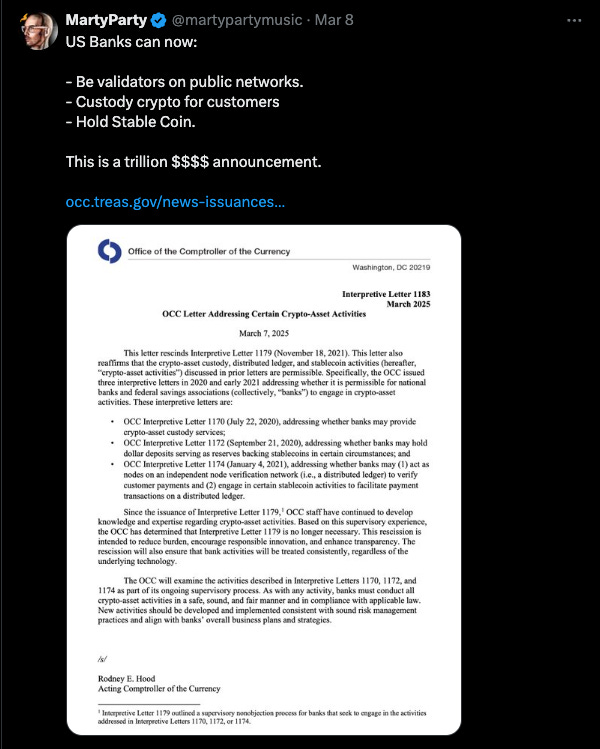

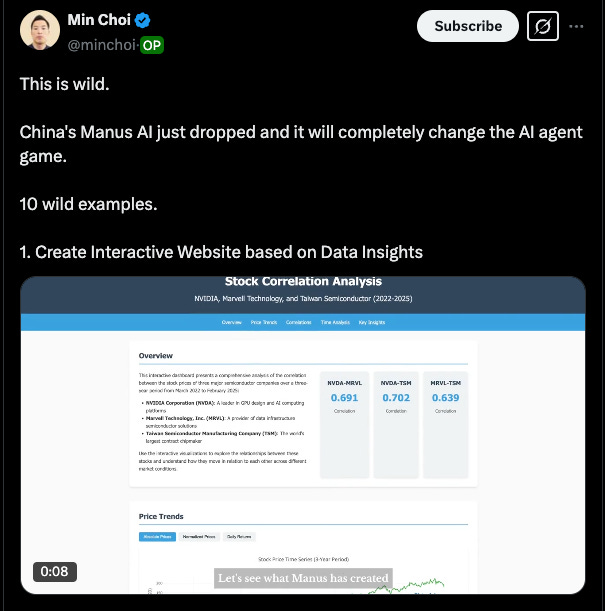

Alpha Bites and Tweets

That’s a wrap.

Thanks for reading!

Till next Friday,

Viktor DeFi.

PS: I’d love to hear your feedback and comments.