tokenized stocks going crazy

The numbers and madness

It’s the 87th edition of the Gems Corner and today we will be looking at the biggest updates on tokenized stocks, alongside other alphas.

For the past couple of weeks, we’ve been exploring the fast-emerging crypto stocks narrative and what it means for our industry. Today, we’re taking it a step further as tokenized stocks go live on-chain.

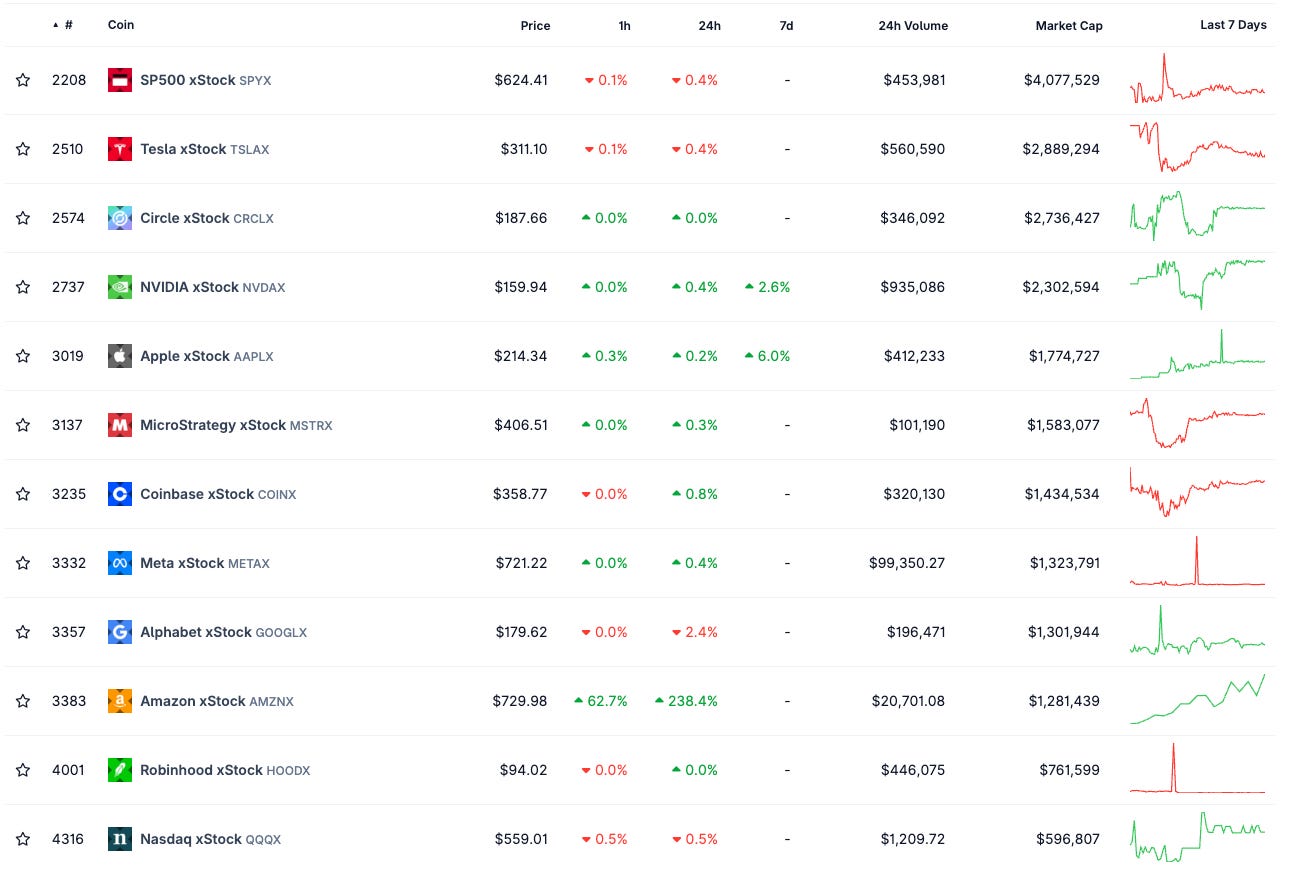

Backed Finance’s xStocks and Robinhood are the two frontrunners in stock tokenization. Let’s start with xStocks. These are 1-for-1-backed ERC-20/SPL tokens that mirror real equities such as AAPLx, TSLAx, and MSTRx. More than 50 tokenized stocks are now available on-chain on Solana and on centralized exchanges like Bybit, Gate, and Kraken.

Here’s how it works:

xStocks is essentially a Swiss-engineered conveyor belt that turns Wall Street paper into on-chain Lego. Backed Finance’s special-purpose vehicle (SPV) buys the underlying shares and parks them with a FINMA-regulated custodian (think InCore Bank).

For every share sitting in that vault, the SPV mints an ERC-20 token on Ethereum and a twin SPL token on Solana, each carrying an ISIN and hard-coded supply caps, so the on-chain float can only expand or contract when the underlying inventory moves.

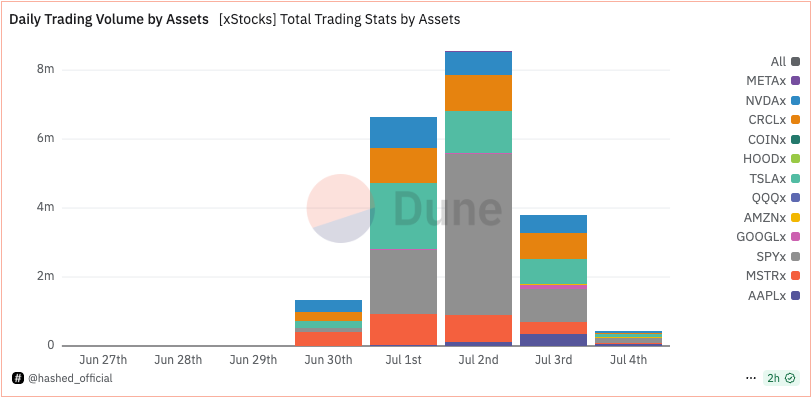

In simple terms, you can now trade your favourite stocks on-chain 24/7 and 24/5 on CEXs with no more restrictions. xStocks has already partnered with protocols such as Raydium, Kamino, Jupiter, and Solflare to boost accessibility and exposure. As a result, daily volume for xStocks surpassed $8 million on day three of launch, signalling strong adoption and market readiness.

This week, Robinhood unveiled its own blockchain and announced plans to let European customers trade more than 200 U.S. stocks and ETFs as digital tokens. To test the system, the company minted over 200 stock- and ETF-backed tokens on Arbitrum, allowing users to trade Apple, Nvidia, the S&P 500, and more, 24 hours a day, five days a week directly within the Robinhood crypto app.

Best of all, users will pay zero commissions and still receive cash dividends, which pass straight through the token wrapper.

Built on Arbitrium, the Robinhood Chain aims to own the entire flow from brokerage custody to on-chain liquidity, thereby turning yesterday’s five-day settlement cycle into an always-on, programmable equity layer. The future is truly here.

Accounts to follow on X

You’ve probably heard the phrase “you are what you eat.” Well, it doesn’t just apply to food, it also applies to the information you consume. I’ll be recommending four new X accounts on my radar that offer fresh alpha on emerging projects and narratives.

Andrew.moh: drops timely content on protocol updates, narratives and, trading insights.

Dolaking: researches and shares deep dives on projects and emerging narratives.

Wist: Similar to Dolaking, Wist breaks down protocols in a way that even your gradma can understand.

Trader Tardigrade: As the name implies, Tardigrade shares microcaps and other trading alphas.

Image of the Day!

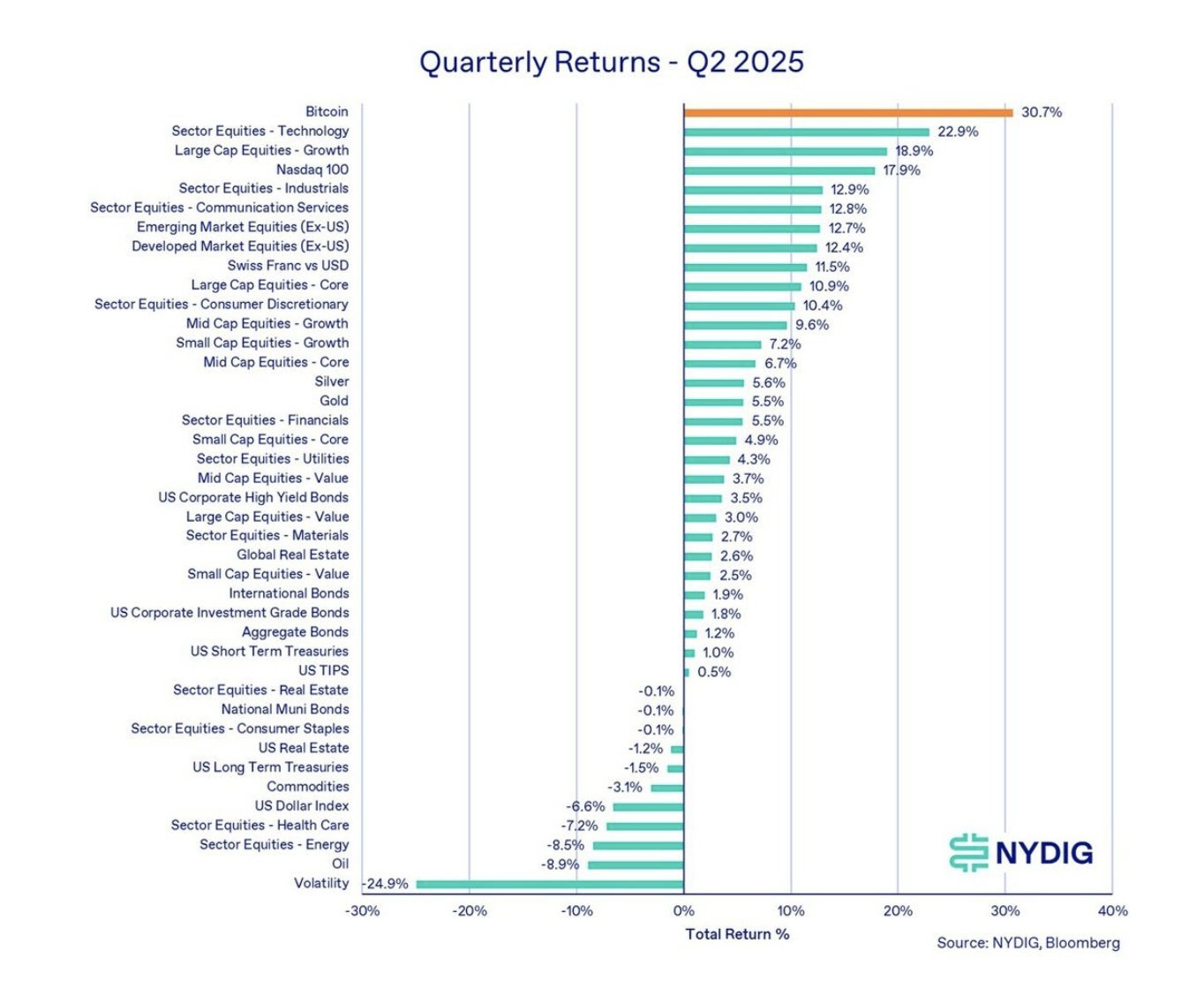

Bitcoin crushed it and is leading in quarterly returns in Q2 2025. It’s Bitcoin world, and we’re living in it.

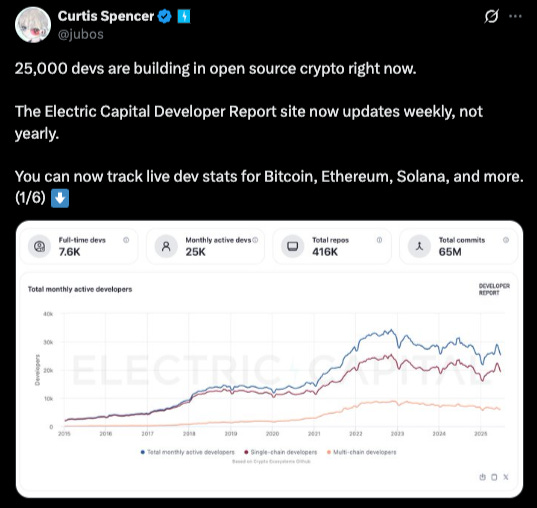

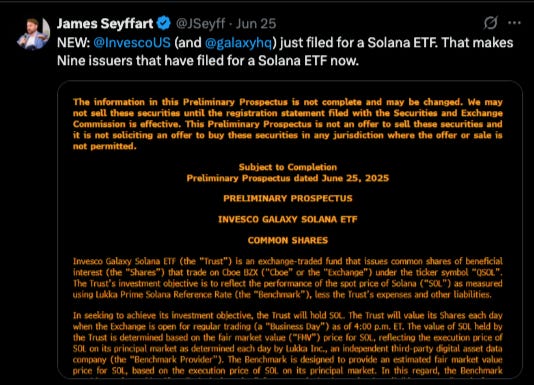

Alpha Bites and Tweets

That’s a wrap.

Thanks for reading!

Viktor DeFi.

PS: I’d love to hear your feedback and comments.

Can you redeem them to real stocks offchain?