the rise of neobanks

neobanks are fast-emerging

It’s the 93rd edition of the Gems Corner, and today we will be looking at the rise of neobanks, alongside other alphas.

In the past few years we’ve seen a bifurcation in financial services: on the one hand legacy banks, on the other new-wave fintechs. Now we’re watching a third axis emerge: neobanks built around crypto (or crypto-friendly from the ground up).

Unlike your regular neobank cards, they challenge the traditional banking model by layering in DeFi primitives like staking, on-chain yield, self custody, and seamless swaps cross-chain.

In essence, your online debit card can do much more asides making online transactions and paying bills. The beauty of these platforms is that they collapse the separation between fiat banking and crypto asset management by offering one app to hold, spend, invest both normal money and tokens.

Key growth drivers include:

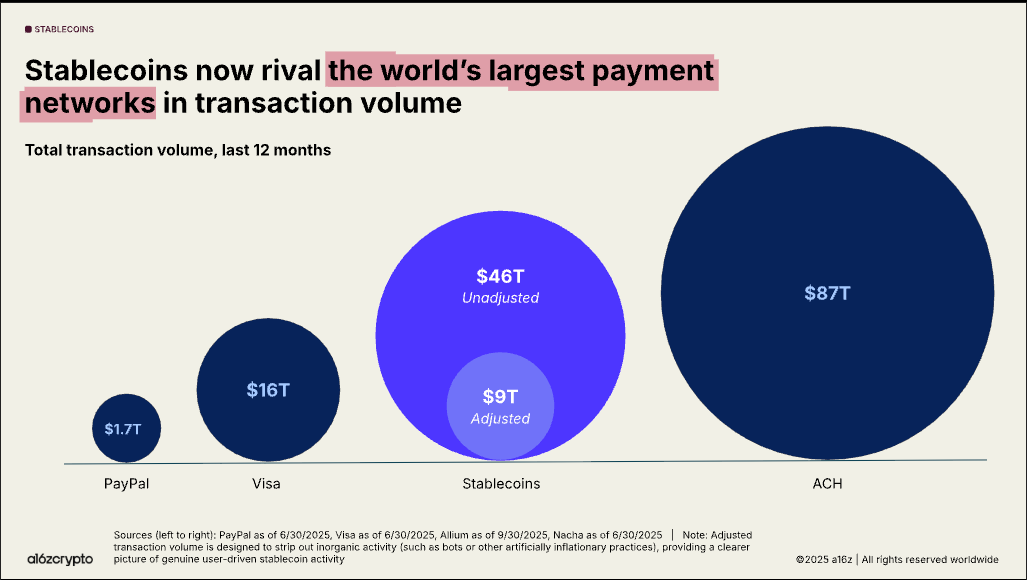

Stablecoin Adoption: Rising usage of USDC, USDT, and regional stablecoins for payments and remittances.

Regulatory Clarity: EU’s MiCA framework and U.S. GENIUS Act providing compliance pathways.

DeFi Integration: Platforms offering 4-10% APY on stablecoins versus traditional 0.5-1% savings rates.

User Demographics: 93 million crypto owners in the U.S., with 85% preferring bank-integrated access.

Here are a few neobanks I’ve tried lately:

1. Payy

They’re a stablecoin-native banking platform built with privacy at its core. On Payy, users can send and receive money with zero fees and also get debit cards for online transactions.

I’ve used their card to pay for some of my subscription services, and the experience was seamless and fast — highly recommended. Interestingly, their points rewards program is now live, so you can start making transactions on the app to stack points.

Join here

2. Tria

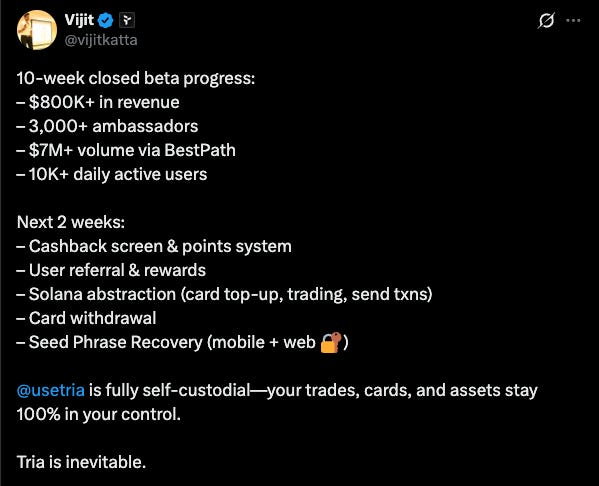

They’ve emerged as one of the most advanced self-custodial solutions, having raised $12 million in pre-seed funding in October 2025. Tria offers a crypto-enabled card that can be topped up with over 1k cryptocurrencies and used in more than 150 countries.

They’ve been quite loud with their marketing, and at this pace, they could attract significant transaction volume — especially since they already have a solid product. Tria also just announced their sale on Legion, and I think it’ll perform well — not just because of the neobank craze, but because the product itself is strong. (Not financial advice, though.)

I was fortunate to test their beta version, and I really like their UI and the additional services it offers.

3. Etherfi

EtherFi (ETHFI) is interesting because it began as a restaking protocol and is pivoting into the neobank domain. Now positioning as a crypto-native neobank, their business model includes cards, staking and yields, and cashback rewards.

They’re currently running a Triple Dip campaign. With about 400,000 $ETHFI up to grabs - users can deposit into their vaults and make transactions with their cards to participate. Looks very tempting, and woth participating.

Join here to get 1% cashback on all your purchases.

4. Avici

Avici is a next-generation digital bank built for the crypto-native age. It blends the functionality of a traditional neobank with self-custodial crypto wallet infrastructure, enabling users to hold, spend, swap and borrow against crypto and fiat seamlessly

With a Visa-powered card, on-ramp to USD/EUR accounts, self-custody by default, and global reach (150+ countries), Avici aims to give people control over their money again.

Use my code “PMDMYX” to sign up for 10% discount.

5. Plasma One

After a successful launch in September, Peter Thiel-backed project - Plasma, is set to launch Plasma One, an onchain neobank that allows customers spend and earn yield on stablecoins from a single platform.

Built on Plasma’s Layer-1 blockchain, it targets emerging markets (about 150+ countries) with zero fees on stablecoin payments, cashbacks, and up to 10% yields annually.

You can sign up for their waitlist here

Other worthy mentions:

Coinbase One Card

Tuyo (invite link)

X Place (join waitlist)

MetaMask Card (on waitlist)

UR Global (by Mantle)

USX Capital (by Scroll)

It seems like everyone’s joining the party and no one wants to miss out. But here’s the thing: you can’t use all of them; that would just spread you too thin. Pick the one that works best in your region and fits your needs.

On the bright side, it’s worth exploring as many as you like - especially the emerging ones, to farm airdrops. Their KYC requirements are naturally filtering out sybils and lazy farmers, so there might be a huge upside. Keep clicking.

Alpha Bites and Tweets

That’s a wrap.

Thanks for reading!

Viktor DeFi.

PS: I’d love to hear your feedback and comments.

Whats the advantage of neobanks in comparison to using ByBit account, which offers everything you might need?