the infoFi craze

the newest hot narrative going crazy!

It’s the 84th edition of the Gems Corner and today we will be looking at the infoFi craze, alongside other alphas.

The crypto industry is driven largely by narratives. This time, it’s becoming more interesting because of the pace at which narratives move. Just when we were trying to fully enjoy the Internet Capital Markets (ICM) narrative, infoFi enters the scene.

The term infoFi (information finance) sits where AI, big data, and blockchain collide. Instead of raw data, the unit of value becomes actionable context which is verified, timestamped, and traded just like liquidity on-chain.

Vitalik calls it “designing a market to optimally elicit truth.” Prediction markets are the first stop, but the real end-game is any system that rewards the crowd for surfacing facts faster than the noise.

In short: Data → Signal → Tokenised Incentive → Network Effects = InfoFi flywheel.

Kaito was the first mover in the infoFi space, now also dominating as the market leader. They secured $10.8 million in funding from leading VCs and have generated about $32 million in annualized revenue in Q1 2025.

Here’s how Kaito works in plain English: It fetches thousands of fresh posts from X and other platforms, vectorises them, and the LLM ranks which clusters are spiking abnormally. Then, the terminal returns a heat-map neatly displaying the clusters by mindshare.

Aside from narrative mindshare, Kaito has other interesting features like dashboards & APIs, metasearch, copilot, catalyst calendar, and much more. They’ve redefined the content and marketing game on X, projects are now turning to them for marketing campaigns.

Cookie, on the other hand, debuted its infoFi platform called ‘Cookie Snaps’ recently. Cookie Snaps lives inside cookie.fun and acts as a project-to-creator marketplace. Posts on X are parsed by Cookie AI; each one earns Snaps points that stack into a public leaderboard.

There are two segments to it:

Global Snaps: Join the platform + referrals (10 % of referee’s Snaps)

Campaign Snaps: Post for a specific sponsored drive

Total Snaps = Global + Campaign.

SparkFi’s pilot pumped $COOKIE volume 18 % in four hours, showing attribution is liquidity. With Cookie Snap, marketers can finally trace the full funnel, that is, tweet → click → swap, and only pay for wallets that converts.

Interestingly, there are also other infoFi players worth watching like Wallchain, Ethos Network. Mirra Terminal, Fantasy Top, and a few others.

In the last cycle, we fought for liquidity. In this one, we’ll fight for context. The winners won’t be the loudest voices, they’ll be the fastest validators of reality. We are already seeing this play out with the recent Loudio trend, and its Initial Attention Offering (IAO).

How to Play the InfoFi narrative

Yap on active campaigns on Kaito

Stack global Snaps by referring users to Cookie

Snipe campaign snaps with high-effort threads and tweets

Put Kaito’s top-moving tickers into your Snap content to climb on both leaderboards.

Use Kaito and Cookie’s leaderboards to get project tokens early before they go viral and pumps.

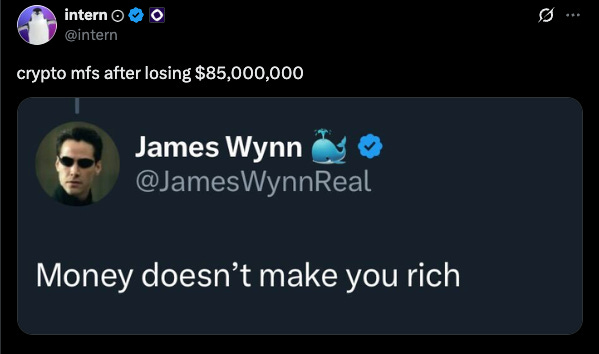

Tweet of the day

Alpha Bites and Tweets

That’s a wrap.

Thanks for reading!

Viktor DeFi.

PS: I’d love to hear your feedback and comments.