The Great ETH Squeeze

ETH IS ASCENDING: The Institutional Era Has Begun

It’s the 88th edition of the Gems Corner, and today we will be looking at the great ETH squeeze, alongside other alphas.

Ethereum is making noise again and not the usual slow-and-steady ETH style. We’re talking vertical candle, multi-billion dollar inflows, and an entire market pivoting in its favor.

If you’ve been wondering why ETH is flying all of a sudden, let’s unpack what’s really fueling this rally and why the bulls might just be getting started.

1. Rising Demand for Spot ETH ETFs

U.S.-based spot ETFs saw net inflows of $2.18b last week, a new all-time high for net weekly inflows. This is a relentless flow of capital into ETH. Everyone is buying, from retail to hedge funds to asset managers.

The best part is that this changes the demand dynamics completely. These ETFs need to back their shares with real ETH, not paper derivatives. Which means, actual spot market buying consistently to meet the demand.

2. Smart Money is Buying

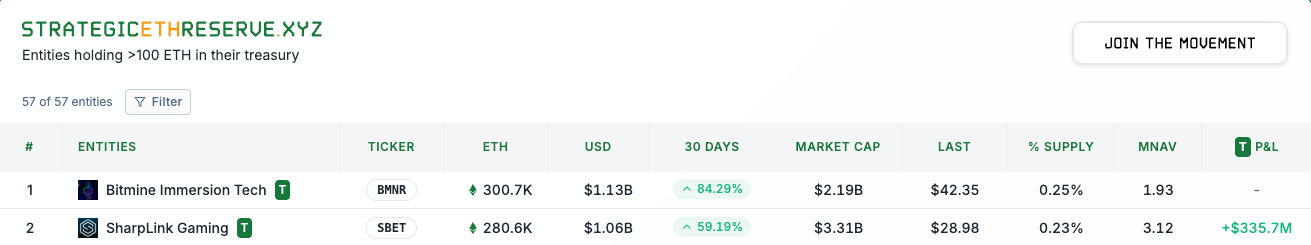

With the rise of the altcoin treasury reserve model, public companies are now creating ETH reserves to gain exposure.

For instance, BitMine Immersion Tech, a mining and treasury outfit backed by Peter Thiel’s Founders Fund and led by Tom Lee. They now hold over 300,000 ETH and are still accumulating more. SharpLink Gaming is closely behind them with over 280,000 ETH in holdings - adding ETH as a core treasury reserve.

Why? Ethereum is becoming more than an asset: it’s infrastructure. The backbone of tokenization, stablecoins, RWAs, and AI-driven automation. If you're a forward-thinking treasury manager, it’s a no-brainer.

3. On-Chain Metrics Are Screaming “Bullish

Zoom out and look at the fundamentals.

Over 317,000 ETH were withdrawn from exchanges in July alone - roughly $1.2 billion in supply gone from CEXs. That’s not traders rotating. That’s accumulation.

Around 30% of Ethereum’s total supply is now staked, removing it from active circulation. That’s nearly 36 million ETH locked up and unavailable for selling.

Network activity, especially in rollups, L2s, and staking-related transactions are climbing fast, suggesting real usage.

4. The U.S. Policy Winds Are Turning

The recently signed GENIUS Act brings the kind of clarity is exactly institutions were waiting for.

More importantly, it signals that Washington is finally starting to separate Ethereum and crypto infrastructure from speculative meme-coins. ETH is being recognized as the foundation of tokenized finance, stablecoin settlements, and programmable money.

And guess what? If the SEC greenlights staking for spot ETH ETFs, that opens another floodgate of inflows. BlackRock, Fidelity, and Grayscale are all lining up.

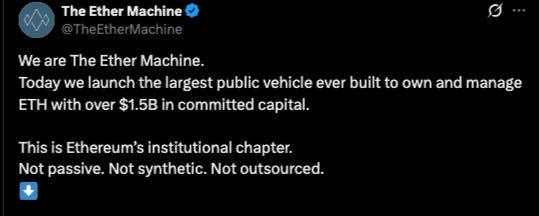

This isn’t a meme wave. It’s the institutional era of Ethereum. And it’s just getting started.

Might also be a great time to look into other ETH beta plays.

Alpha Bites and Tweets

That’s a wrap.

Thanks for reading!

Viktor DeFi.

PS: I’d love to hear your feedback and comments.