tarrifs and market insanity

Liberation day turn rekt day

It’s the 81st edition of the Gems Corner and today we will be looking at the Liberation Day’s tarrif announcement and its effect, and alphas.

Recently, President Trump announced his bold "Liberation Day" tariffs aimed at reshaping trade dynamics, specifically targeting China and select foreign imports. While politically charged and economically controversial, its financial ripples extend far beyond mere geopolitics.

The global financial markets have been feeling the heat: from stock to crypto markets.

Markets thrive on certainty—and tariffs deliver the opposite. Immediately after the announcement, U.S. indexes faced downward pressure, led by tech giants heavily reliant on global supply chains.

Companies like Apple, Tesla, and NVIDIA felt the pinch, sliding notably as investors braced for increased costs and reduced margins. Interestingly, about 2 trillion dollars was wiped from the stock market, following the announcement.

Industries heavily intertwined with China, such as semiconductor manufacturing and automotive sectors, are now reevaluating strategies.

On the other hand, the crypto market wasn’t badly hit, as coins like BTC, ETH, and XRP saw a little dip. Although it might still affect the crypto industry in unexpected ways, especially in areas of hardware devices, Bitcoin mining, and regulatory backlashes.

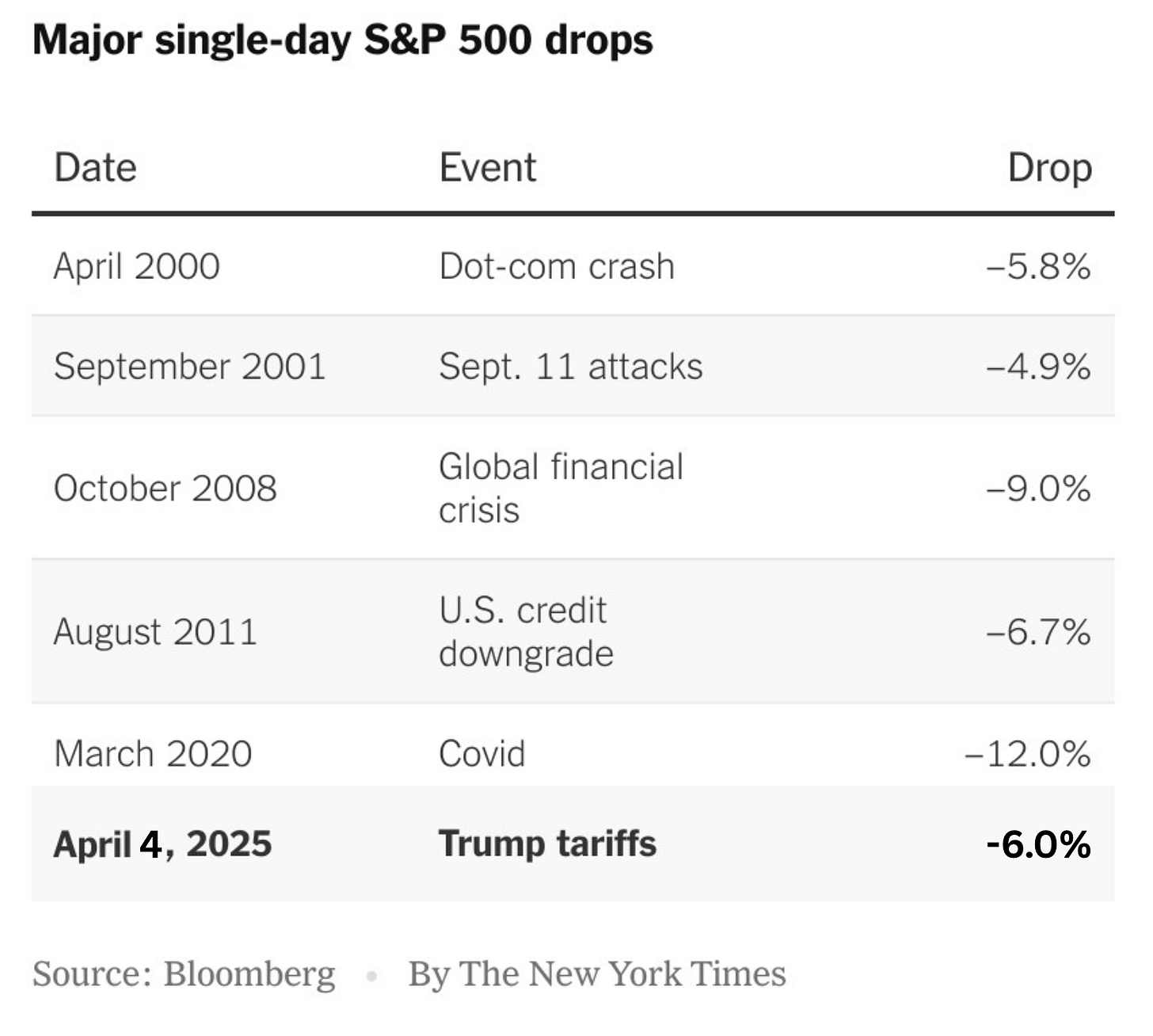

April 4th, 2025, will go down in history as a single day with one of the major S&P drops as mentioned in the above image. However, while it was a bad day for stocks and companies, retail saw it as an opportunity for wealth creation. Retail investors bought $4.7 billion in stocks yesterday, the most in a decade. Time will time whether or not it’s a wise decision.

As always, there are opportunities in every market - you just need to look a bit closer.

Image of the day

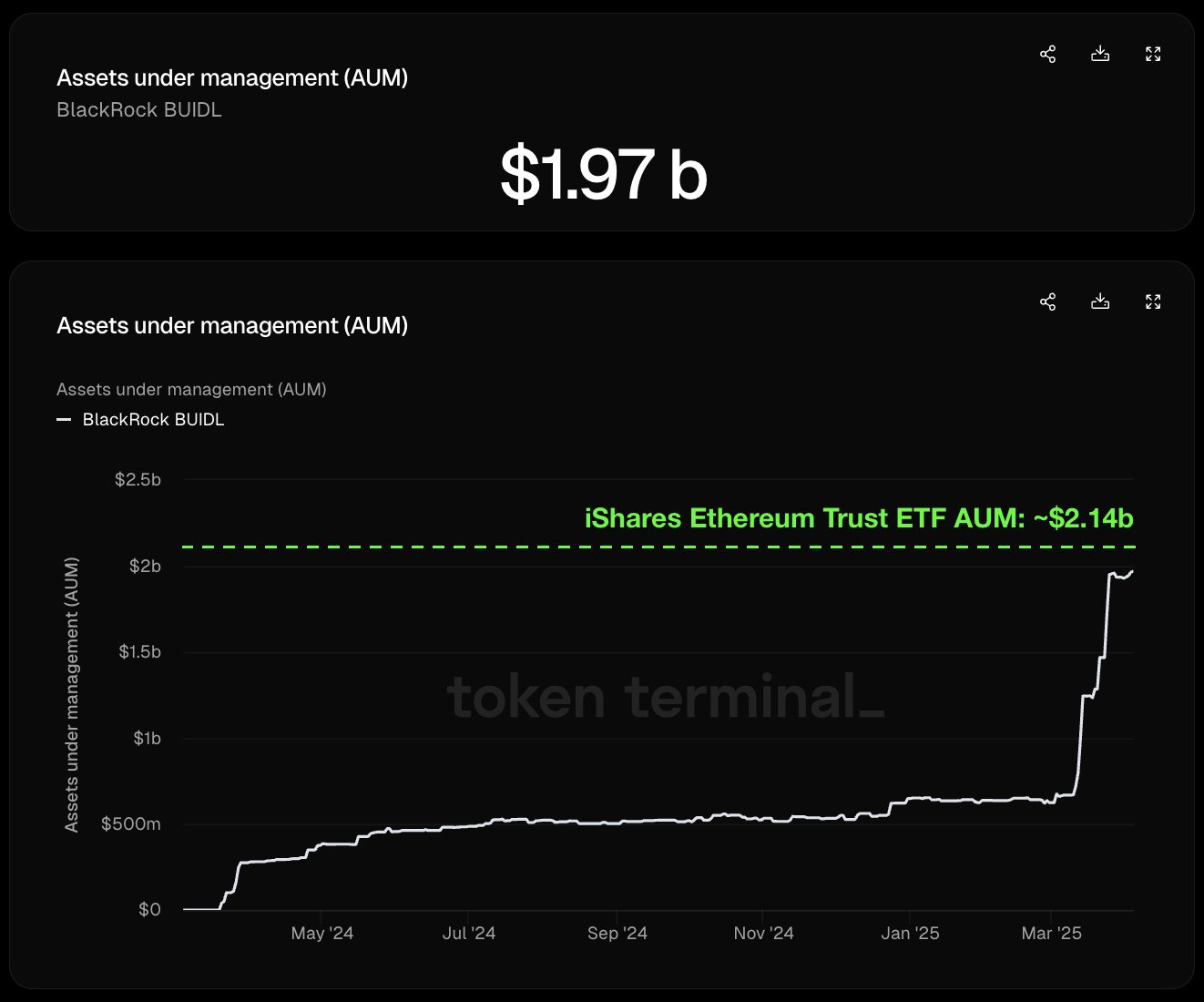

The AUM of BlackRock’s BUIDL money market fund is almost surpassing the AUM of the AUM of the firm's ETH ETF. Tokenized funds are unstoppable!

Alpha Bites and Tweets

That’s a wrap.

Thanks for reading!

Till next Friday,

Viktor DeFi.

PS: I’d love to hear your feedback and comments.