Stablecoins Era is Here

What is and what's to come

In the 29th edition of the Gems Corner, we’ll examine the current state of stablecoins, their widespread adoption, and other gems.

The stablecoins market has been growing steadily for the last couple of years. Despite regulatory backlash and the current bear market, stablecoin adoption keeps expanding daily.

Let’s analyze the state of stablecoins.

USDT dominates the stablecoins market with about 69%, closely followed by USDC and BUSD. However, the high margin of USDT’s dominance is due to the USDC depeg earlier this year and BUSD’s issuance saga.

Binance announced that it’ll cease support for BUSD by February 2024 following Paxos’ move to halt the production of new BUSD. This decision will change the dynamics of stablecoins as either a new player will step up, or the existing players will exert more dominance.

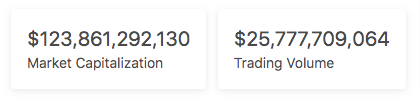

At a market cap of $123B, the stablecoin narrative is coming up strong. As crypto payments and platform platforms increase, this market cap is set to almost double in about a year. Here are some key statistics and catalysts.

In 2022, stablecoins settled over $11tn on-chain, exceeding volumes processed by PayPal and almost surpassing that of Visa. This is such an incredible feat, as it shows the extent to which people are turning to stablecoin over the existing payment giants.

According to the Breven Howard Digital Stablecoins research, over 25mm blockchain addresses hold over $1 in stablecoins - of which 80%, or close to 20mm addresses, hold between $1 and $100. In context, a US bank with 25mm would rank as the 5th largest bank by number of accounts.

As the popular saying goes, if you can’t beat them, join them. PayPal and Visa recently made bold moves in crypto. A few weeks ago, PayPal announced the launch of its dollar-backed stablecoin - PayPal USD (PYUSD), with Paxos Trust Co as its issuer.

Additionally, Visa recently expanded its USDC stablecoin settlement capabilities to the Solana blockchain. In context, Visa and PayPal have a cumulative of over 2.9 billion users globally - the stablecoin adoption wave is upon us.

We believe that stablecoins and CBDCs can play a meaningful role in payments.

- Visa CEO

The rise of fiat-to-crypto payment apps is another catalyst that’ll blow up the stablecoin narrative. More users will turn to crypto payment applications worldwide in developing and unbanked regions.

Especially as rising inflation hits most of these developing economies, people will use stablecoin as a hedge to protect their wealth and investments.

Lastly, the RWA narrative is a strong catalyst for adopting stablecoins. As shown in the above image, the value of RWA on-chain recently reached a new all-time high of $3.1 billion.

This is great news for the stablecoins narrative because the top stablecoin issuers, Tether and Circle, allocated part of their reserves to invest in Tradfi instruments to gain exposure to Tradfi yields. Following MakerDAO’s huge success in the RWA space, which constitutes about 58% of its revenue.

As the tokenization of new instruments grows, so will the attractiveness of stablecoin yields and users. Considering the market condition, too, most users will prefer yields in stables - driving its holdings and users.

That’s it for today. I’ll analyze CDPs and decentralized stablecoins in a subsequent issue.

Actionable Strikes

Debank Airdrop Strategy - link

Mantle 20M Incentive Program - link

Sign up for Heroes of Mavia waitlist - link

Interact with Bedrock and earn points - link

Gold Threads

That’s a wrap.

Thanks for reading!

Until next Friday,

Viktor DeFi.

PS: I’d love to hear your feedback and comments.