Ripple Effects & Bulls

Hey, friend!

It’s the 5th edition of Gems Corner. Today, we’re shining light on the ripple effects of the SVB collapse, bulls & other alpha bits.

Enjoy the gems.

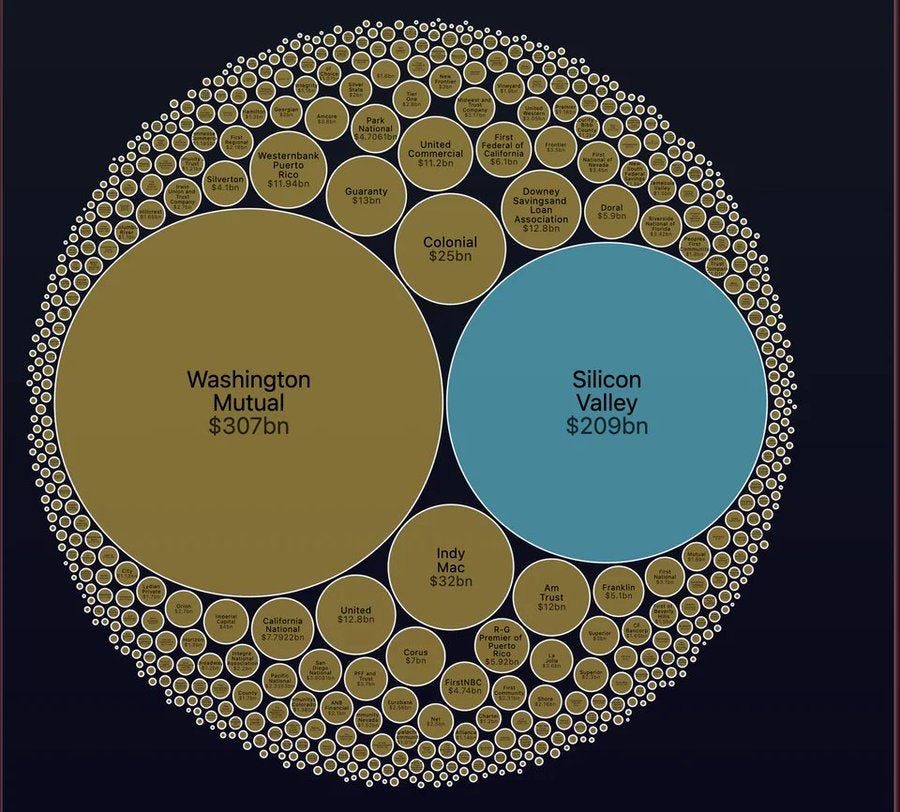

Last weekend, one of the United State’s biggest banks - Silver Valley Bank (SVB), collapsed. Not just that, it is also the second-biggest collapse in the history of the United States banking system after Washington Mutual.

Wondering what triggered the collapse? Here’s an insightful comment from James Angel, an expert on regulating global financial markets at Georgetown University, that explains it.

SVB collapsed because of a stupid rookie mistake with their interest-rate-risk management: They invested short-term deposits into long-term bonds. When interest rates rose, the value of the bonds fell, wiping out the equity of the bank.

What’s interesting here is that SVB transcends retail investors and customers. It is a bank for tech startups and unicorns, including crypto-native projects. That means, whatever affects it, also affects tons of startups and organizations.

But this newsletter is not an exegesis of the SVB collapse; many media outlets have captured that already. Rather, it analyzes the positive and negative effects on the financial and, most importantly, the crypto community. Negative Effects and Exposures…

The First and most-crucial effect on the crypto industry is SVB's impact on Circle's USDC stablecoin. As you may already know, USDC is a fiat-backed stablecoin combining cash and US Treasuries.

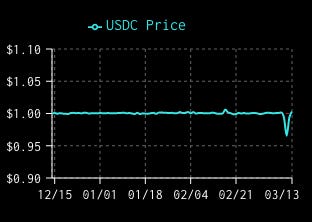

However, they had $3.3bn of USDC cash reserve with SVB, exposing them to the collapse. This exposure, coupled with Binance's halt of USDC-BUSD auto-conversion and Coinbase's withdrawal, threw the crypto industry into panic, leading to USDC de-pegging from USD.

Even though the gravity of Circle USDC’s exposure wasn’t much, FUDDings on Twitter scared users, followed by massive USDC withdrawals and conversions. But, as of writing, the peg has been restored, and USDC is doing fine.

Here are other contagions and effects…

The contagion within the U.S. banking system might be more than it seems. Centralized financial institutions operate in a web effect, not as an isolated entity. That means a stain on SVB is a stain on many other financial agencies, as captured in the thread mentioned by Genevieve Roch-Decter.

The SVB collapse also impacted many tech startups incubated by YCombinator. This and much more exposures.

Positive Effects on Crypto Protocols

As a result of the panic over USDC’s de-peg, crypto users heavily withdrew and converted their USDC into other crypto assets.

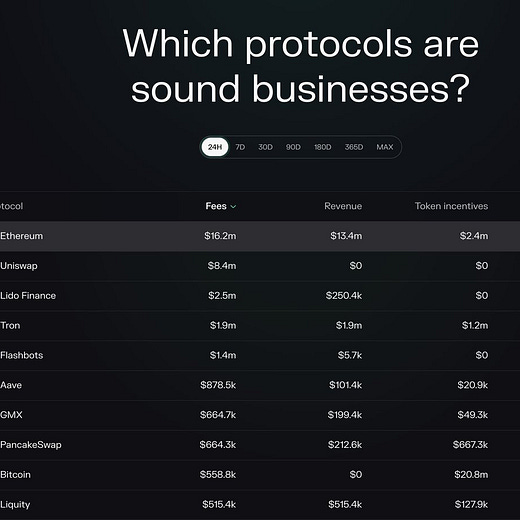

The SVG saga led to a massive revenue of about $11 million via fees from swaps and withdrawals on the Ethereum network. A good weekend for Ethereum, indeed, lol. That’s not even all.

Uniswap also had $12b in daily volume, hitting 11 digits for the first time ever! You’ll agree that this is the ‘best’ day for Uniswap. I bet some other DEXes and chains experienced such too, but I end it here for the section.

Chart of the day

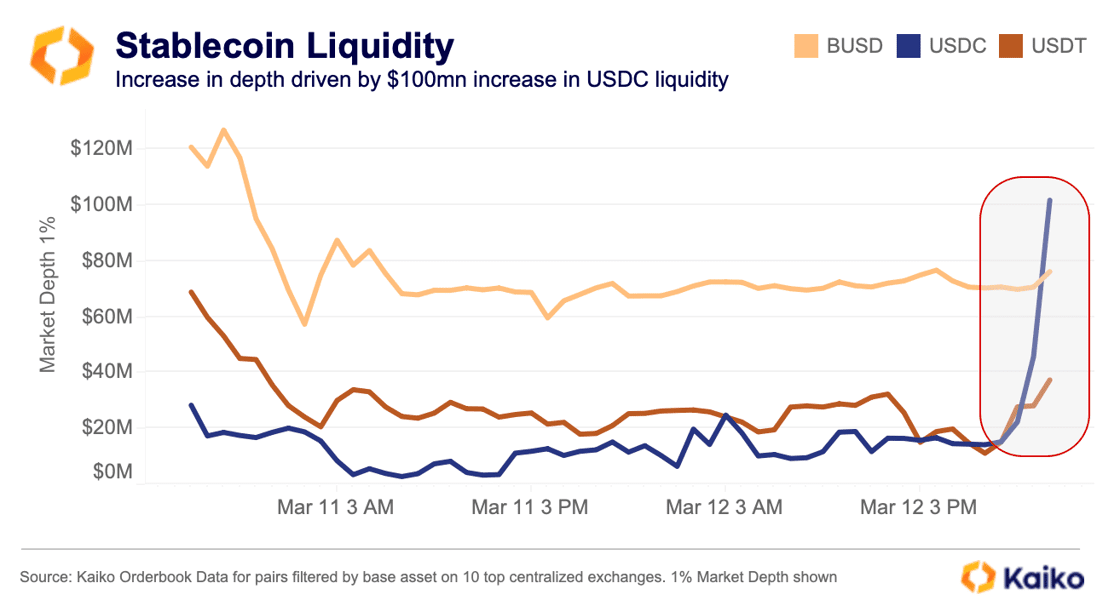

USDC is coming up stronger with a massive injection of liquidity this week on different pairs. It’ll only take a matter of time before it assumes its rightful position.

Alpha Drips

Spoiler alert: I’d add a section on airdrops & mints from the 6th edition, don’t miss it.

Also, I will appreciate your feedback.

Thanks for reading!

Until next Friday,

Viktor DeFi.

Thanks for this round-up, Vicktor🔥Really helps.

Keep up the good work, I appreciate it.