Ripple Awakens the Crypto Market

A win for ripple is a win for the entire crypto industry

The 21st edition of Gems Corner highlights the winning case for Ripple, the rise of the crypto service narrative, and other solid alphas.

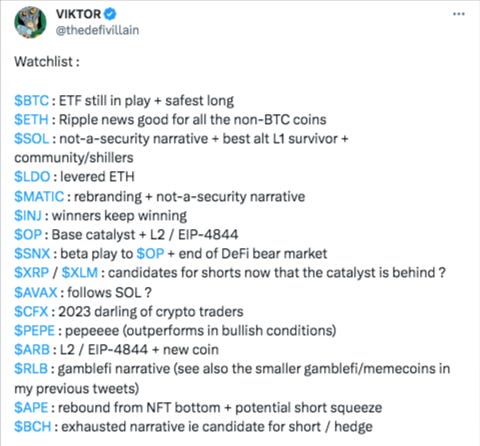

The much-anticipated news came into crypto this week as the judge ruled in favor of Ripple Labs in their case against the Securities and Exchange Commission (SEC).

If you’d recall, in 2020, SEC filed a lawsuit against Ripple and two of its co-founders on the grounds that they misinformed investors by raising $1.3 billion in unregistered securities since 2013.

So, in the lawsuit, Ripple Labs were trying to prove that they were $XRP is not a security. Of which the recent ruling vindicated the token and the co-founders involved.

Immediately after the ruling, the $XRP token surged by 29%. Not just that, major exchanges and DEXes like Coinbase, Kraken, CryptoCom, BitGo, Gemini, and Bitstamp listed XRP.

This is not just good news for Ripple but also for the entire crypto community. Based on the fact SEC has recently filed lawsuits against Binance and Coinbase, Ripple’s victory signals a victory for other exchanges.

Rise of Crypto Services Narrative

Coinbase and Circle are front-running the crypto services narrative that could onboard the next billion into crypto.

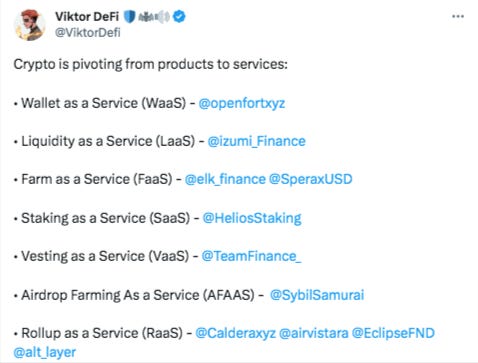

Recently, I tweeted about crypto pivoting from products to services with a couple of examples. The thing is that the crypto services trend is coming up faster than we can imagine.

Don't take my word for it. Earlier this year, Coinbase announced its Wallet-as-a-Service (Waas) solution to enable companies to adopt wallets using their infra.

Then recently, Circle, USDC Issuer, also announced its Wallet-as-a-Service platform to provide the relevant infra for dev to adopt wallet services easily.

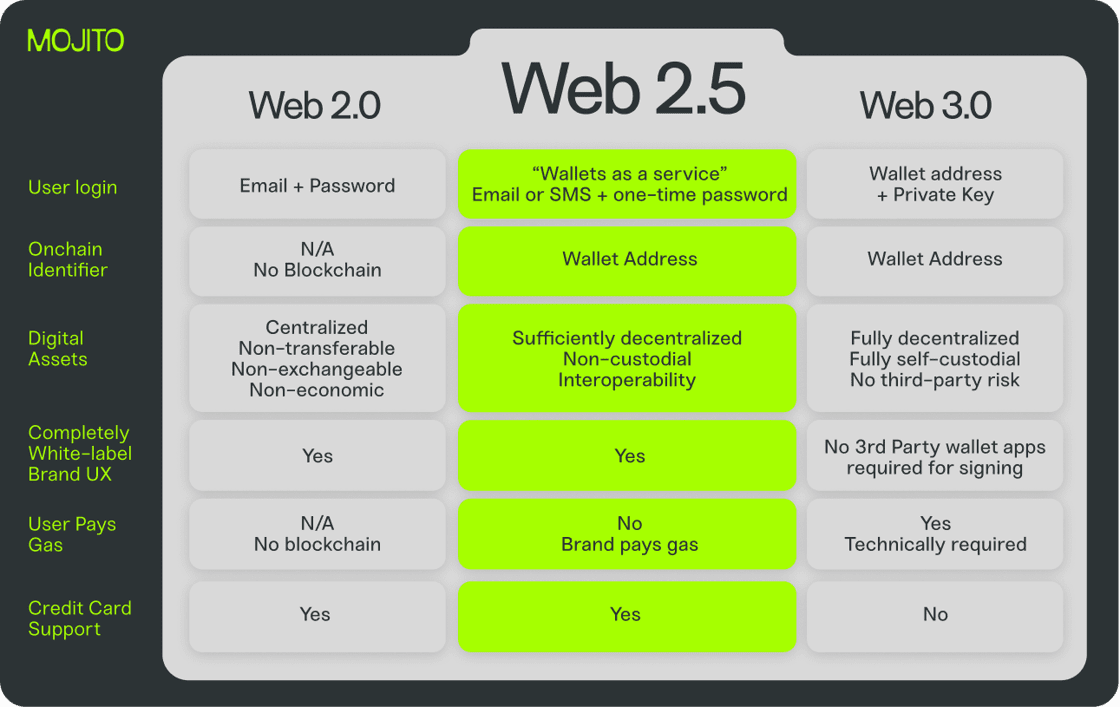

WaaS is at the intersection of web2 & web3 and would help onboard non-crypto native companies & users, respectively. The attached graphics explains this.

The use cases for WaaS include:

digital marketplaces

token-gated events

on-chain rewards program

In-game tokens and rewards

community building rewards

and the list goes on...

My take is that WaaS could easily take crypto mainstream. Crypto wallets will soon be integrated into most websites like Stripe and PayPal & stablecoins payment will be a norm. Even religious organizations & NGOs will adopt it. The storm is coming, fren.

Vela Exchange is Becoming Exciting

Since Vela’s official launch a couple of weeks again, the platform has kept shipping new pairs and introducing other features.

This week they listed XRP and PEPE. And also increased their USDT and Forex leverage to 250x and crypto to 100x. Exciting times are ahead for Vela.

You can trade on Vela Exchange with my referral link here to support my work.

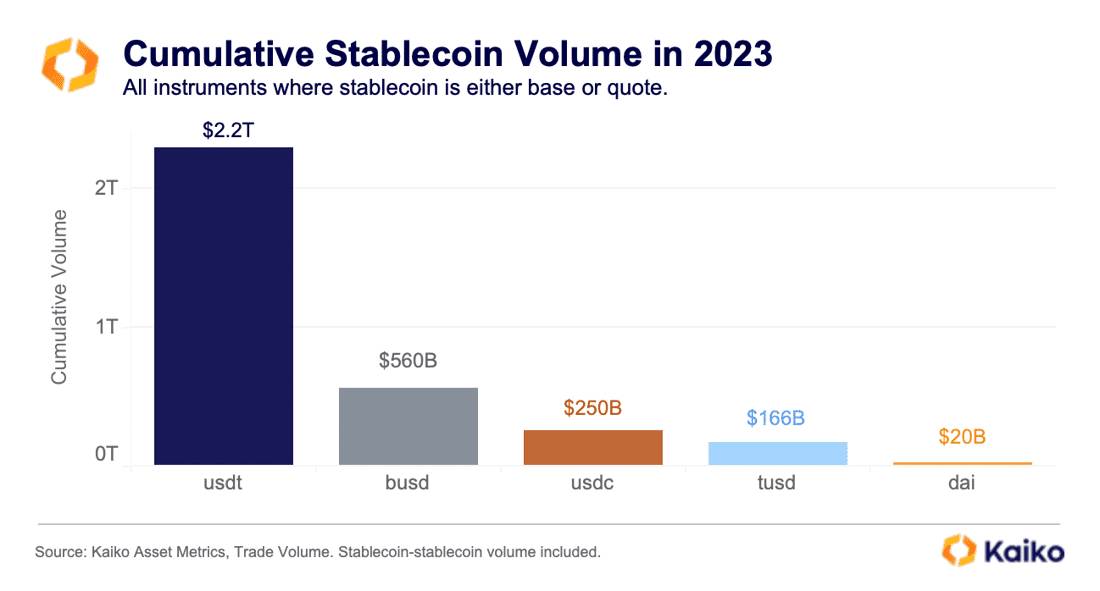

Chart of the Day

USDT continues to exact dominance over the stablecoins market. Even so, the huge-gap margin is due to some obstacles faced by the two competing stables:

BUSD: Paxos, BUSD’s issuer, halted the issuance of the stables earlier this year.

USDC: The recent depeg caused by Silver Valley Bank’s liquidation crisis.

Actionable Strikes

FTX Claims portal is now active - link

Vote on Stargate's recent snapshot proposals - link

WhiteBIT’s step-by-step airdrop guide - link

Taiko alpha-3 testnet is live - link

Polyhedra launches NFT campaign on galxe - link

Phase 1 of the Arbitrum Ambassador Program is now live - link

Project Updates, News & Gems

Polygon proposes a token rebrand to POL - link

Binance Labs invests $15 million in Xterio, a gaming company - link

Coingecko partners with Telegram bolt, Unibolt - link

Aave’s stablecoins, GHO, set to be deployed on Ethereum’s Mainnet - link

MakerDAO's total Real-World Asset (RWA) portfolio hits 2.34 billion DAI - link

Algorand's largest DeFi app, Algofi, shuts down - link

SEC acknowledges Blackrock Bitcoin spot ETF application - link

Europe to launch first spot Bitcoin ETF - link

Thanks for reading!

Until next Friday,

Viktor DeFi.

PS: I’d love to hear your feedback and comments.