new narratives, everyday

Pokémon's resurgence and exotic RWAs

It’s the 91st edition of the Gems Corner, and today we will be looking at Pokémon's resurgence and exotic RWAs, alongside other alphas

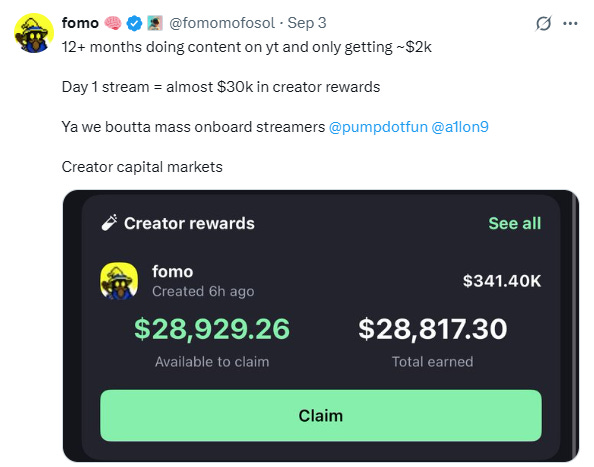

The real-world asset story just found an unlikely new contender: Pokémon trading cards. What used to be childhood collectibles traded in back rooms and convention halls are now going on-chain as tokenized assets with global liquidity.

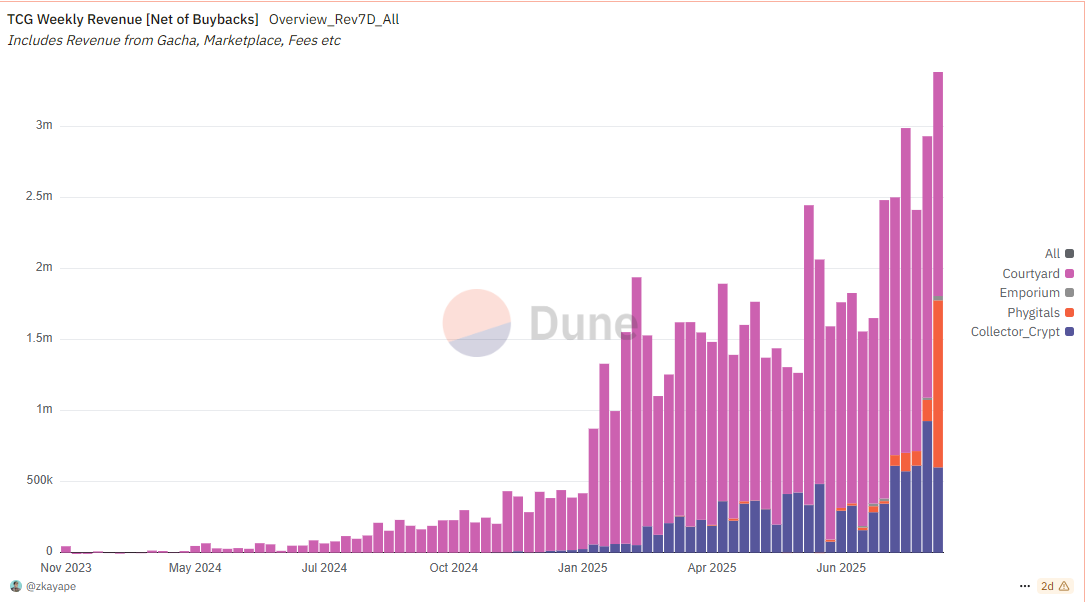

Platforms like Collector Crypt and Courtyard.io are leading the charge, giving Pokémon TCG its own RWA narrative.

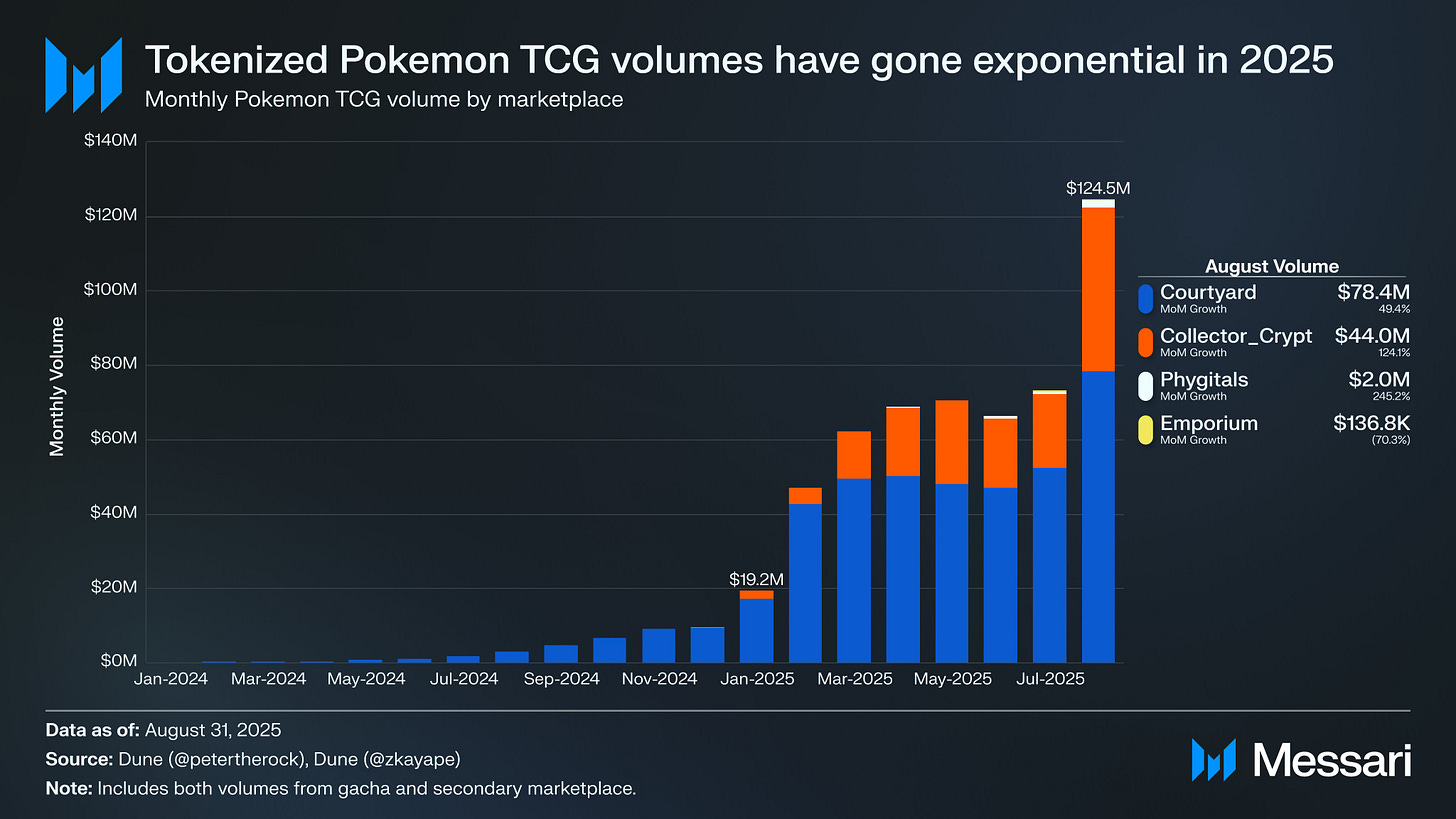

The numbers are already staggering. In August, tokenized Pokémon card trades touched roughly 124 million dollars in volume. That is a reasonable jump from earlier this year, and it is already eclipsing traditional RWA experiments like tokenized equities.

The message is clear. Collectibles are no longer just nostalgia. They are fast becoming a new frontier of financialization.

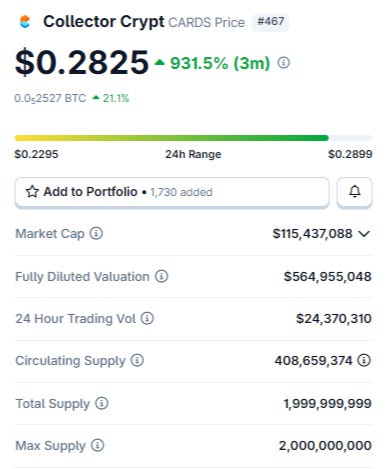

Collector Crypt is the Solana-native play, and it has exploded. Its token, $CARDS, did a whopping 1157.6% increase within seven days and now sits at a fully diluted valuation of $560 million. The Gacha product is the growth engine and the speculative core.

.

Courtyard.io on Polygon is a different beast. It leans institutional, securing partnerships with Brink’s for custody and vaulting. It has raised around 37 million in funding and handled around 78 million dollars in trading volume in August. The focus here is less about speculation and more about redemption, security, and long-term credibility.

If RWAs are going to scale, cultural assets like Pokémon may just be the gateway. They merge nostalgia, liquidity, and financial innovation in a way that resonates far beyond the crypto native circle. The lesson is that RWA adoption does not always start with bonds or real estate. Sometimes it starts with Pikachu.

Other tokenized Pokémon card platforms worth paying attention are:

TCG Emporium

Phygitals

Beezie

Boxed

Exotic RWAs - A New Meta

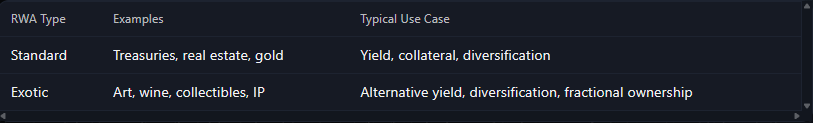

Last week, I stumbled upon a new term ‘Exotic RWAs’ on X as defined by Messari Copilot. It defines it as the tokenization and on-chain representation of non-traditional, often alternative, real-world assets within the crypto and DeFi ecosystem.

‘While standard RWAs typically include assets like government bonds, real estate, or commodities, "exotic" RWAs expand this concept to less conventional or more complex asset classes’ - it further explains.

I think exotic RWAs are gonna be huge. Collectibles have already shown us a taste of the market demand for alternative assets on-chain. The floodgates will soon be open for exotic assets to scale on-chain.

Toyow is on my radar. They’re building a marketplace that brings films, real estate, and music on-chain. Will be looking out for more in this category.

Alpha Bites and Tweets

That’s a wrap.

Thanks for reading!

Viktor DeFi.

PS: I’d love to hear your feedback and comments.