Instadapp: The Ultimate Aggregation Layer in DeFi

Rise of DeFi Aggregators

Hey friend, today’s project research edition focuses on Instadapp, an aggregation layer in Defi. Enjoy the gems.

The internet we use today differs from what was prevalent in the 90s. Back then, finding web content was difficult until Google solved the content discovery problem through its aggregator.

Now, we are witnessing the rise of billion-dollar aggregator platforms solving vital issues on the internet. For instance, Amazon for finding things, Facebook for finding people, and Google for finding content, to mention a few.

For the blockchain industry to advance, there needs to be key aggregation platforms that address the discovery challenges of its users. That’s precisely where Instadapp comes in. Instadapp aims to become the ultimate aggregation layer in DeFi by aggregating various DeFi protocols.

Instadapp is among the leading protocols in DeFi, easily out-pacing other protocols by creating timely products that the industry needs. Wanna find out more? Let’s dive.

What is Instadapp?

Instadapp is a middleware protocol that simplifies and unifies the front end of DeFi. Like the web2 aggregators mentioned initially, Instadapp brings the best DeFi platforms under one roof for easy accessibility and unified experiences. The platform currently unifies eight protocols: MakerDAO, Liquity, Morpho, Aave, Compound, Lido, Uniswap, and Hop Protocol.

Users don’t need to switch between protocols when they can achieve everything with a few clicks. The best part is that Instadapp is live on Ethereum, Polygon, Arbitrum, Avalanche, Optimism, Fantom and Base, helping users maximize their time and fees on-chain.

The Tech Behind Instadapp

Instadapp leverages a novel technology known as DeFi Smart Accounts (DSA) to drive more flexibility and accessibility to users. DSA is a smart contract controlled by users, enabling them to execute multiple actions in a single blockchain transaction. Think of DSA as a user's sub-account on Instadapp, which lets users manage positions and easily interact with DeFi protocols in a trustless manner.

These DSAs are generated using regular Ethereum accounts. All you have to do is connect your Ethereum wallet to Instadapp Pro to create your DSA account; boom, you’re in the DeFi multiverse. Interestingly, it allows users to create as many accounts as they want in a trustless manner. Also, users can withdraw their funds back to their Ethereum wallets at any time with zero restrictions.

Another incredible thing about DSAs is that connectors extend them. Connectors enable developers to build on DSAs, unleashing more functionalities, actions, and use cases. For instance, the connectors can be many things ranging from protocols to Auth connectors.

Using Instadapp’s unified experience, users can do the following:

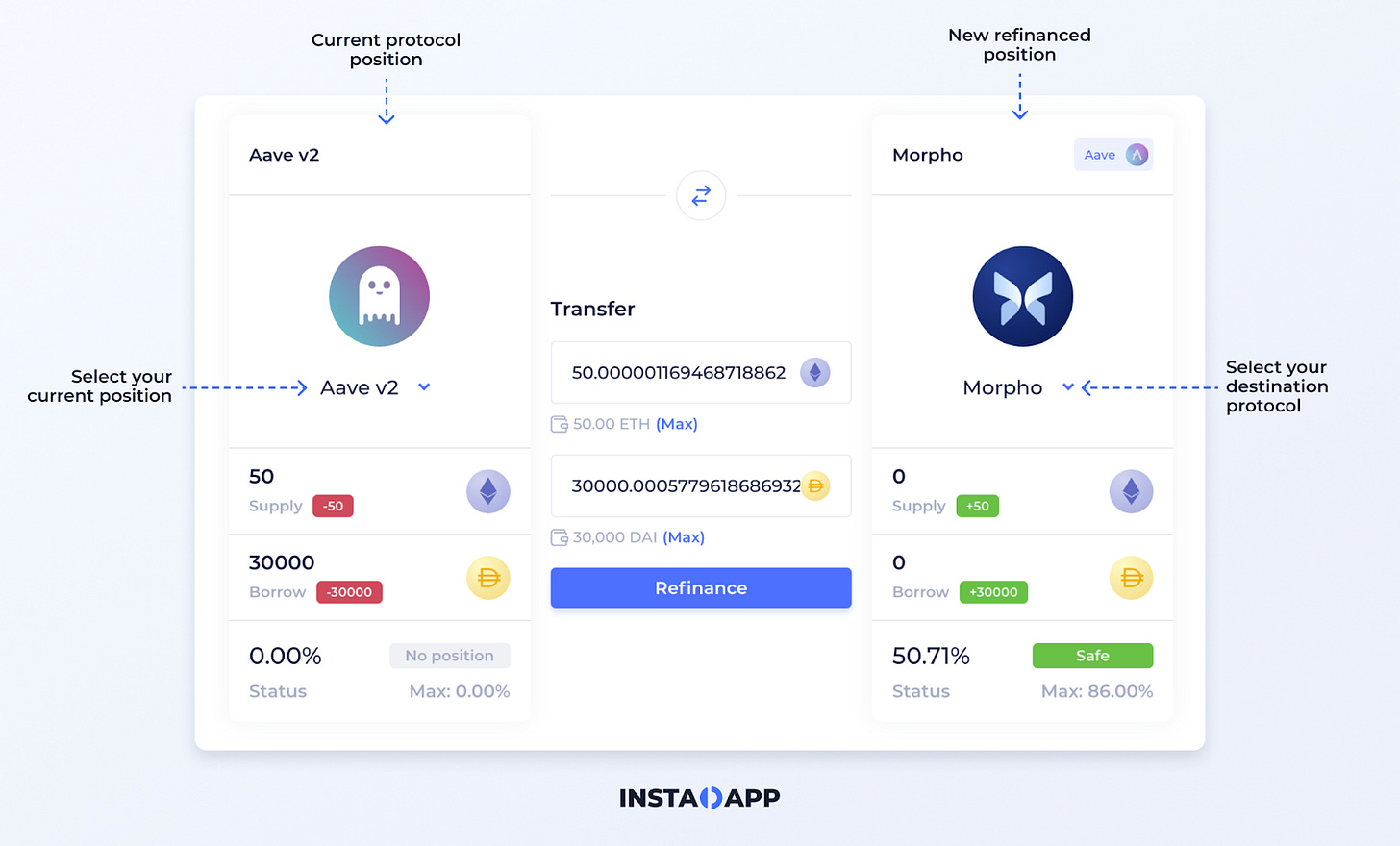

Multi-Protocol Refinancing

Lending and borrowing are one of the leading use cases of decentralized finance. Users use multiple lending protocols that suit their strategies to open and finance debt positions once they’re up. Instadapp’s multi-protocol financing functionality allows users to migrate positions and refinance loans between top lending protocols in a few clicks.

Cross Chain Bridge

Blockchain bridges exist because of the need to transfer crypto assets from one network to another. With Instadapp, users could easily withdraw from their DSAs to another network, saving both gas fees and time.

Sweep Swap

We all have those tokens in our wallets that we’re either not using or are tired of holding. You can swap such tokens for a single token using Instadapp’s Sweep Swap functionality.

Protection Automation

Automation is disrupting every industry, and DeFi is no exception. The protection automation feature enables users to automate debt re-payments in market uncertainty. It only takes a small fee between 0.3% and 0.4% for each automation event.

Flashloan Aggregator

Instadapp’s flashloan aggregator leverages an advanced routing mechanism to discover the best rates for flash loans across leading providers like Aave, MakerDAO, Balancer, Compound, and more. It launched with seven routes, providing users access to a broader pool of liquidity & tokens for lower fees.

That’s not all; Instadapp also manages a flashloan pool, which is utilized as the source for the aggregator. This enables the aggregator to become a competitive and price-efficient platform for flashloans. Since its launch, Instadapp’s flashlaon aggregator has maintained steady growth in its revenue.

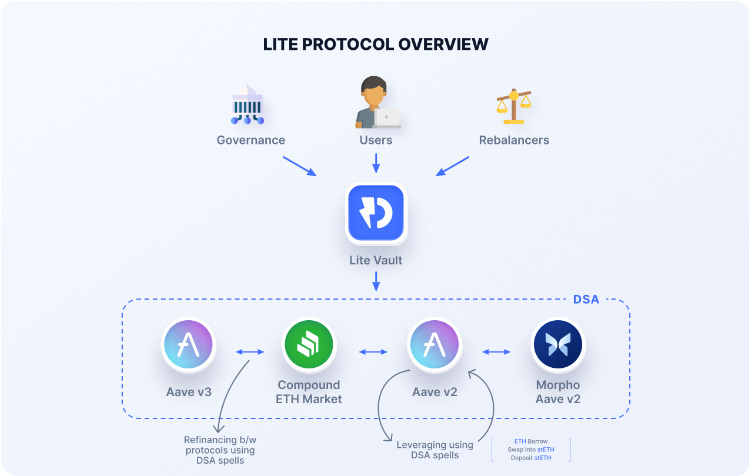

Instadapp Lite

Instadapp Lite is the DeFi yield powerhouse of the Instadapp platform. It scans through multiple lending platforms to source the best strategies and APRs for its users, all of which can be accessed with a single click. Easy accessibility and simplicity are at the core of Instadapp Lite.

Earlier this year, the team launched Lite v2 with an ETH-only vault. The vault is strategic and timely following the rise of the liquid staking narrative. The vault supports Aave v2, Compound’s ETH market, Morpho, & Aave v3 and has amassed over $311M in cumulative locked value.

ETH Lite Vaults on Idle Finance

Idle Finance, a yield automation protocol, recently announced integration with Lite Vaults. This is exciting and revolutionary for many reasons. First, Idle Finance leverages tranche systems, facilitating more tailored risk strategies and options for Lite Vault users. Second, it creates two options for new and existing users to earn real yields depending on their risk threshold.

The senior tranches are slightly below the standard lite vault with a custom loss-protection mechanism, while the junior tranches cover the senior tranche with boosted APRs. Individuals and institutions that require an extra layer of protection for their assets will likely lean towards the senior tranche, while degens will prefer the junior tranche.

Avocado

Avocado is Instadapp's latest innovative product frontrunning the account abstraction narrative. If you’ve been a DeFi user for a while, you’re probably used to connecting your wallet to a dapp, switching networks, paying for gas fees in the network’s native token, and adding new chains via Chainlist if you want to interact on a new chain.

But Avocado changes all of that. It’s an innovative smart contract wallet that allows users to perform multi-network transactions using the Avocado network. Eliminating the need to switch between networks while saving gas fees.

Avocado owns its RPC. Even so, it's not a blockchain. Avocado RPC is the Network Aggregator that searches for the available broadcaster to handle a transaction on a given chain, as illustrated in the attached chart. The best thing about Avocado is its trio abstraction model: network, gas, and account abstraction.

Network abstraction ensures all network balances are accessed on a dashboard, gas abstraction facilitates transactions using USDC as the native gas fee, and account abstraction provides superior modularity in design while opening the platform to novel use cases. With these, Instadapp could easily be the leading abstraction and aggregation layer in DeFi.

The platform creates a native Avo wallet address for you once you’re connected to Avocado’s RPC Network. With that wallet address, you can perform everything and enjoy the same level of security that’s obtainable with your Externally owned accounts (EOA) like Metamask. The team also hinted at some upcoming developments on Avocado, which include 2FA security, balance unification, roles, defi strategies, and developers' incentives program.

Tokenomics

$INST is the governance and utility token of Instadapp. It has a max supply of 100,000,000 INST and a market cap of about $30M. Of which 55% is allocated to community members, 23.8% to team members, 12.1% to investors, and 7.9% to future teams and advisers.

$INST is undervalued at its current price of $1.2. Instadapp seats on $1.9B billion in TVL, and the token did an all-time high of $24.40 in the last bull market. With the recent and upcoming developments on Instadapp, it’s easy to predict a much higher alt in the next bull market - not financial advice.

Wrapping Up

As I mentioned earlier, we are seeing an emergence of innovative blockchain aggregators. And like Google and Amazon, they aim to become intermediaries between DeFi protocols and users, onboarding users and driving the ecosystem's growth.

My research shows that Instadapp is relentlessly establishing itself as the ultimate aggregation layer in DeFi across different verticals. At this pace, it’s only a matter of time before Instadapp achieves the same network scaling effect as its Web2 counterparts.

great work 👍

Thanks very clear!