ICM - the new narrative

are you paying attention?

It’s the 83rd edition of the Gems Corner and today we will be looking at a new narrative - ICM, and other alphas.

Six months ago “Internet Capital Markets” (ICM) was just a fad. Today it’s a full-blown narrative where any idea: an app, brand, or even a software can IPO in minutes. Messari’s newest brief calls it “a new frontier in capital formation”, while outlets from Decrypt to AInvest splash daily headlines on the meta.

So, What exactly is an Internet Capital Market?

Think Kickstarter meets Coinbase. An entrepreneur (or degen) mints a token for their concept; the open market prices the dream in seconds; liquidity becomes seed capital; the community becomes first users.

In practice, that means:

Founders tap retail liquidity without cold-emailing VCs.

Retail traders buy ideas as easily as meme coins.

Protocols plug tokens straight into DeFi money markets, creating instant utility.

You might be wondering why ICM is happening now. Well, it’s because the dots are connecting. Here are a few:

Real yield is back on-chain. Tokenized Treasuries pay 4-5 % without banking hours, perfect collateral for DeFi treasuries.

Cheap blockspace. Solana and the newest rollups push fees below a cent, so spinning up a micro-IPO is technically free.

Narrative heat. ICM trended across Crypto-X this week; influencers label it “the 2025 ICO wave.”

Believe.app ignited the ICM narrative, smashing $6.3 million in fees in 24 hrs, and their token doing 900 % as well. To date, there are 17k+ tokens launched on the platform and their native coin $LAUNCHCOIN is now over $200M in market capitalization.

Essentially, Believe is building a future where attention is the capital and anyone with a good idea can get funded by community, quickly. No more waiting on VCs, founders can get funding from day one.

Could this be the genesis of another billion-dollar narrative or just a fad? Well, time will certainly tell. But for now, you should max it.

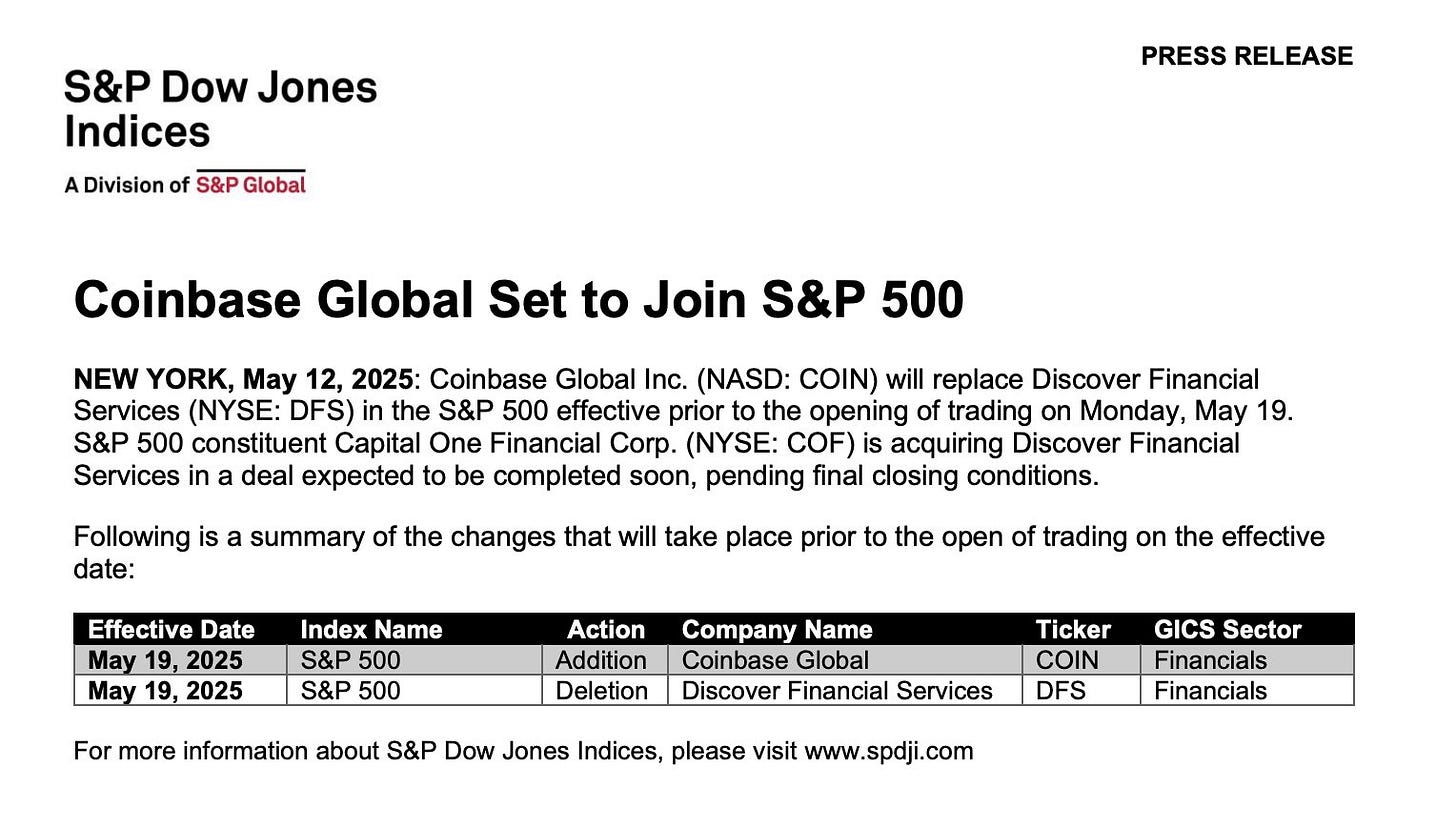

Coinbase to join S&P 500

Coinbase joining the S&P 500 closes the credibility gap between TradFi and digital assets. In case you don’t know about the S&P 500 - Its 500 constituents account for roughly 80 % of U.S. large-cap value and serve as Wall Street’s default benchmark.

This means, Coinbase is the index’s first pure-play crypto company joining the big 500.

The move doesn’t guarantee higher token prices, but it permanently anchors crypto inside the world’s most-watched equity benchmark. Not only is this bullish, but also a signal boost for other crypto-native companies.

Image of the day

The volume of illiquid Bitcoin (BTC) supply which represents the amount of BTC that is rarely sold just smashed an all-time. Never seen a better bullish sign for Bitcoin this week.

Alpha Bites and Tweets

That’s a wrap.

Thanks for reading!

Viktor DeFi.

PS: I’d love to hear your feedback and comments.