Hot Gold Narrative

gold-tokenised stablecoins and more...

Hey, friend!

It’s the 8th edition of Gems Corner. Today, we’ll explore the tokenized gold narrative, Pancakeswap v3, and other gems.

Enjoy the gems.

Tokenized gold assets narrative is becoming the new standard.

Before now, many challenges were associated with gaining exposure to the price of physical gold and its ownership. Some of which are:

Safeguarding it against physical theft

The issue of transporting it from one destination to another

Authenticity verification, exposure, and more, you name it.

Thanks to blockchain technology, the gold market is now on-chain.

Tether Gold (XAUT), PAX Gold (PXG), and other gold-backed stablecoins are heralding a new era of digital gold ownership. This will enable seamless exposure to the price of physical gold, greater utility, and easy accessibility to ETFs.

Tokenized gold assets or gold-backed stablecoins are stablecoins backed by physical gold. Most of these stablecoins are ERC-20 standard tokens built on Ethereum. That means unlike physical gold, they can be stored in any ERC-20 tokens-supported wallets.

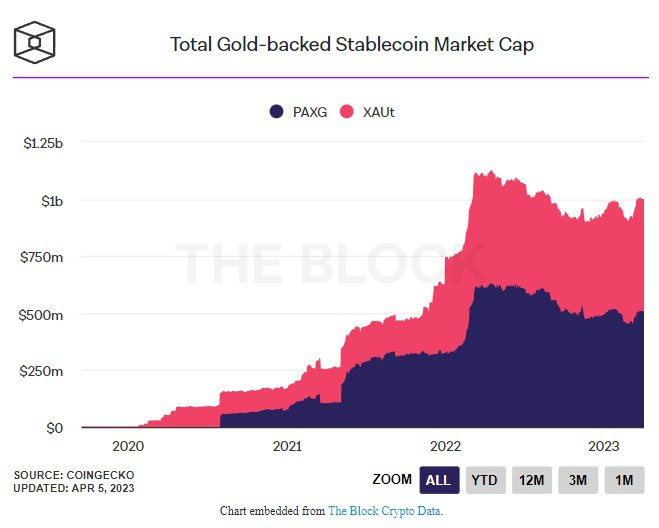

The market capitalization for tokenized gold assets recently crossed a whopping $1 billion mark. It is worth mentioning that the leading gold-backed stablecoins, PAXG and XAUt, are issued by household names in the crypto industry, Paxos Trust Company and Tether.

However, if you compare $1 billion to the market cap for Gold - $13.360T, you’ll realize that gold-backed stablecoins haven’t scratched the surface yet. Even so, it’s not bad for a rising narrative.

We are still early to this narrative, and this is real alpha.

Pancakeswap V3 out of the Box

This week, Pancakeswap announced the official unveiling of their V3 on BNB Chain and Ethereum, with advanced features.

If you’ve been in crypto for a while, then you’re definitely familiar with Pancakeswap - an industry-leading DEX. Essentially, V3 is the advanced and enhanced version of V2, with some incredible highlights like:

Up to 25x lower trading fees for traders as compared to V2

More fee earnings with the same amount of deposits for liquidity providers

Up to 4000x higher capital efficiency, allowing you to earn easily, watch your profits soar, and much more.

You can try it here (aff. link)

Chart of the Week

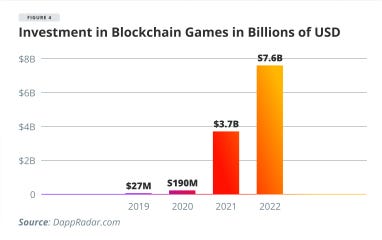

According to BusinessWire, the blockchain gaming market is projected to grow at a Compounded Annual Growth Rate (CAGR) of 70.3% to $65.7 billion in 2027. The ultimate factors driving the market growth are the rising fund for blockchain games and easy penetration.

Currently, the leading gamefi projects are Axie Infinity, Gods Unchained, DeFi Kingdoms, Alien Worlds, and MOBOX.

Alpha Drips

Over 30 projects on Ethereum partners to build a MEVBlocker - link

Tokenized treasury bond OUSG launched by Ondo Finance exceeds $70M - link

OpeaseaPro airdrop strategy - link

Unlimited DeFi’s public sale is happening on the 10th of April - link

20 free crypto research tools for finding solid 100x alphas - link

Lido stakers can expect Eth withdrawals 'No Sooner Than Early May' - link

Stakefish NFT staking hits $1M+ during early access - link

The liquid staking derivatives chart is smiling:

N.B: The Gold Threads section will return once Substack resolves its tweets embeds issue.

Thanks for reading!

Until next Friday,

Viktor DeFi.