bullish case for bitcoin

On why BTC is undervalued

It’s the 83rd edition of the Gems Corner and today we will be looking at the bullish case for Bitcoin, and other alphas.

Having been the first cryptocurrency, Bitcoin has continued to dominate the industry and grow in value. Recently, it has evolved from retail’s "safe coin" to institutional investors’ favorite. Everyone now wants a slice of the pie.

If you haven’t been paying attention, now’s the time. I’ll show you why — with charts and data — so sit tight.

In Q1 2025, Bitcoin increased its dominance of the total crypto market capitalization to 63% — the highest level since 2021. This surge is fueled by rising interest and adoption, from ETFs to broader real-world use cases.

First, let’s look at institutional adoption. MicroStrategy, now known simply as Strategy, was the first publicly traded company to add Bitcoin to its balance sheet as a primary treasury reserve asset. They kickstarted the trend of institutional Bitcoin adoption, and ever since, other institutions and government agencies have been following suit.

To date, about 44 publicly traded companies hold Bitcoin on their balance sheets and counting. Some institutions also have indirect exposure to BTC through ETFs and investment vehicles. Thanks to the surge of institutional funds flowing into Bitcoin ETFs, Bitcoin now accounts for 90% of all crypto fund assets globally and it’s showing no signs of slowing down.

Interestingly, scarcity has never been higher. Unlike other investment assets like real estate, Bitcoin has a fixed supply cap of 21 million coins. This scarcity makes it inherently more valuable, driving its price higher. In fact, it recently outpaced silver, becoming the seventh-largest asset globally by market capitalization.

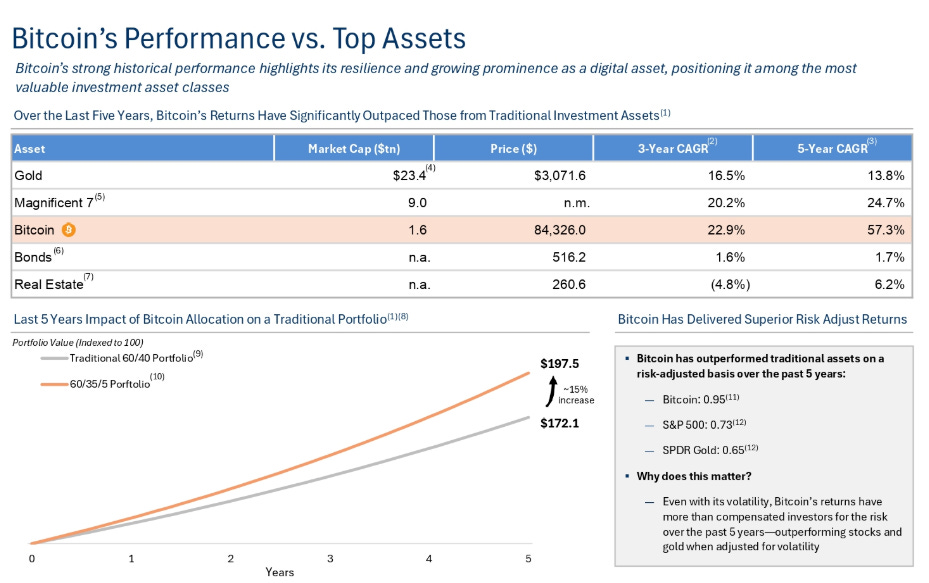

When it comes to profitability, Bitcoin has been killing it too. Over the last five years, Bitcoin’s returns have significantly outperformed those of traditional investment assets like bonds and real estate. In the same period, Bitcoin’s 5-year Sharpe ratio (~0.95) exceeded that of the S&P 500 (~0.73) and gold (~0.65). Long-term holders are also smiling in profits compared to other top crypto coins.

Let’s not forget that in March 2025, the United States Government established a Strategic Bitcoin Reserve - which makes it even more bullish. This is arguably one of Bitcoin’s biggest catalysts as it shifts BTC from a "risky asset" to a strategic reserve in the eyes of policymakers, institutions, and global capital. In simple terms, Bitcoin now has government backing.

Additionally, the Federal Reserve officially published new guidance allowing U.S. banks and bank holding companies to hold Bitcoin (and other digital assets) directly on their balance sheets. It creates a new source of demand and use cases for Bitcoin in the traditional banking sector.

The handwriting is on the wall. There’s never been a better time to be bullish on Bitcoin than now. Position accordingly.

Alpha Bites and Tweets

That’s a wrap.

Thanks for reading!

Viktor DeFi.

PS: I’d love to hear your feedback and comments.