Bitcoin dips and bulls

German gov't teasing the market

It’s the 56th edition of The Gems Corner, and today we will be looking at the sales of Bitcoin by Germany, bullish signs, and other alphas, as usual.

In an unexpected yet impactful move, the German government has recently initiated the sale of seized Bitcoins, causing ripples throughout the cryptocurrency market.

The German government’s criminal investigation unit Bundeskriminalamt, or BKA, initially seized 50,000 Bitcoin, valued at about $2.8 billion, from Movie2k, a film piracy website. So, they recently started selling the asset, crashing the price of Bitcoin from $65k to around $57k.

They offloaded the last 3846.05 BTC ($223.81M) the previous night, emptying their wallet and monetizing all the assets from criminal activities.

However, the price of BTC showed strong resistance against the dump as it didn’t severely impact the market. It only had a 13.9% drop in price in the last 30 days, signaling strength and dominance.

Opportunity in disguise

On the flip side, while the situation is scaring some people out of their bags, retail is seeing it as an opportunity and accumulating heavily throughout this week.

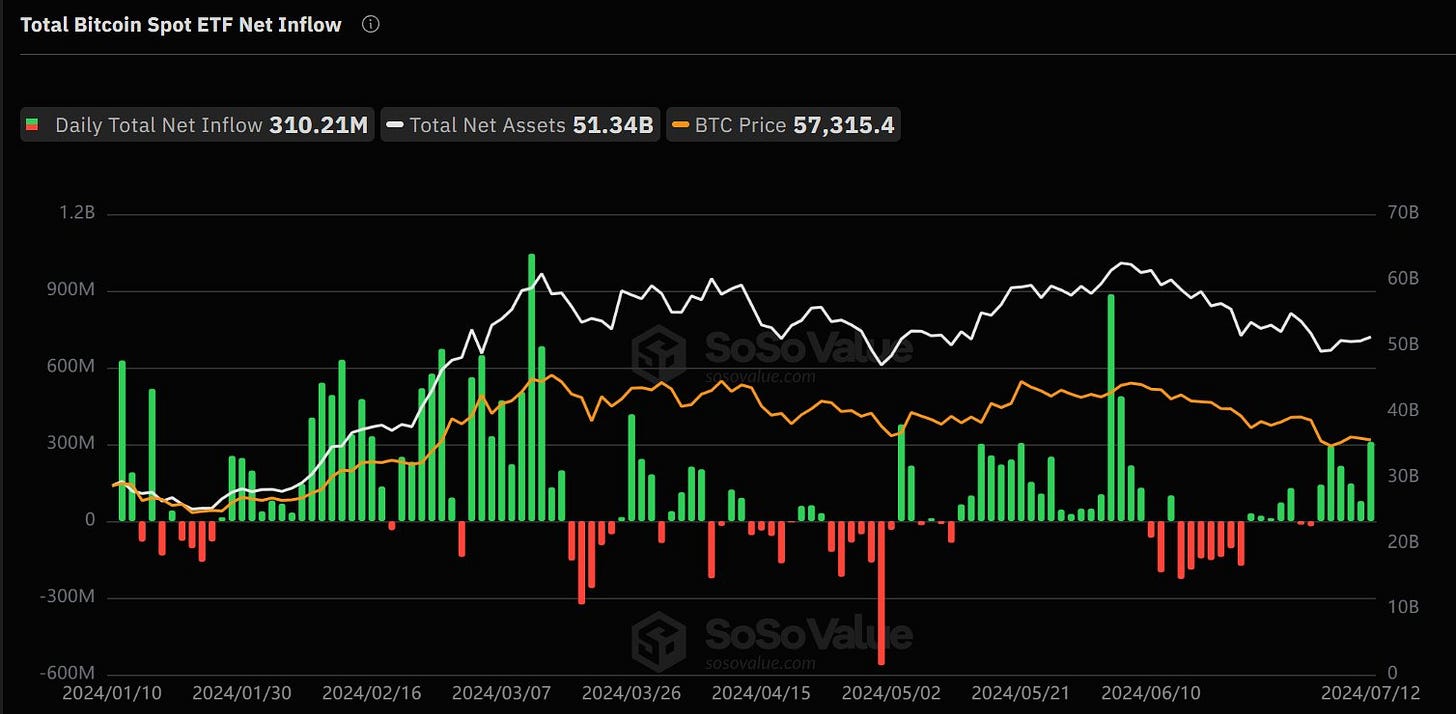

This week saw a total BTC ETF inflow of $1.05B, and a daily inflow of $310M on July 12th, the highest in the past 25 trading days. Interestingly, there was zero outflow throughout the week.

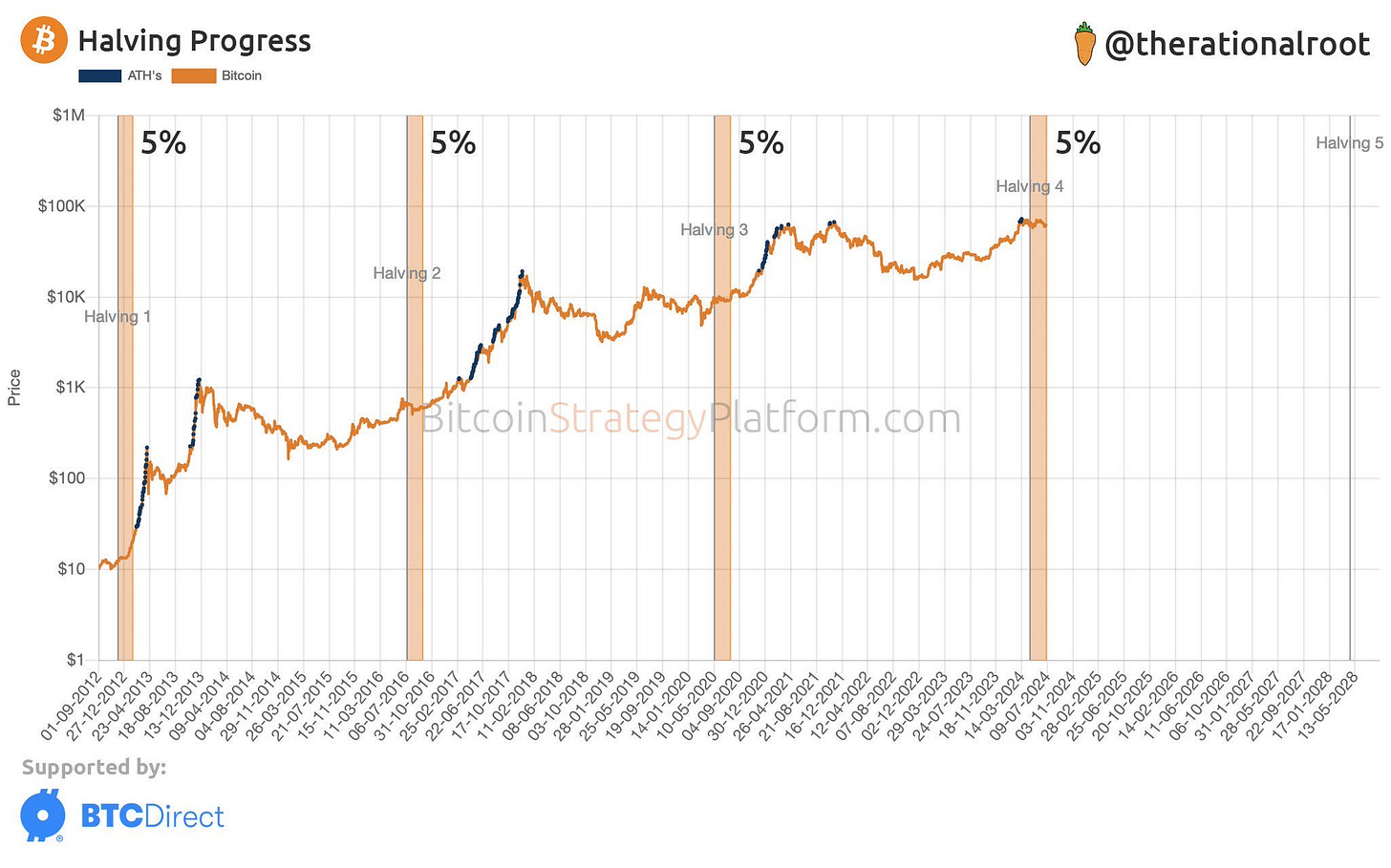

Putting it into perspective, the first 80 days after Bitcoin halving are usually re-accumulation periods before a parabolic run. Historically, this has been accurate in the past halvings.

Even though, at times, past results do not guarantee future outcomes, they give you a clue about possible occurrences. Are you ready, anon? Remembering the words of Degen Spartan…

Alpha Bites and Tweets

That’s a wrap.

Thanks for reading!

Viktor DeFi.

PS: I’d love to hear your feedback and comments.