bearish or discount september?

A closer look at September

It’s the 60th edition of the Gems Corner, and today, we’ll be analysing the month of September from a historical perspective and other alphas.

The market has been dull lately, with the prices of Bitcoin going below $56k and Ethereum below $2.4k, respectively. That’s not even all; there are not many token pumps, TGEs, and IDOs during this period, making it boring.

This newsletter attempts to investigate the reason behind the market’s downtrend.

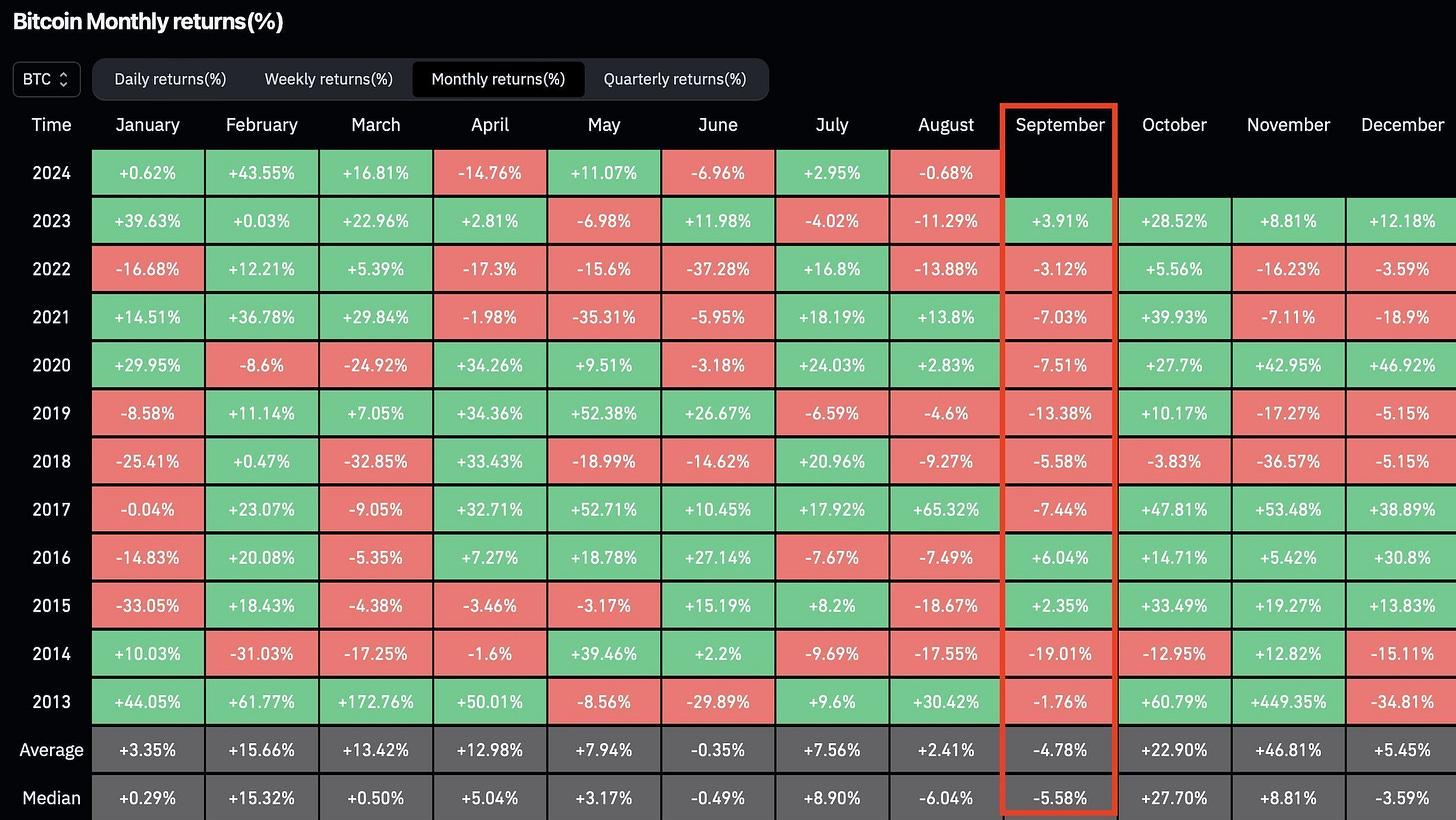

Firstly, September is historically the worst month for global stocks as depicted in the above image. Bitcoin is not an exception as it has been following the same pattern for the past couple of years.

Since 2013, the price of BTC has only had two positives and the rest are negatives as shown in the image below.

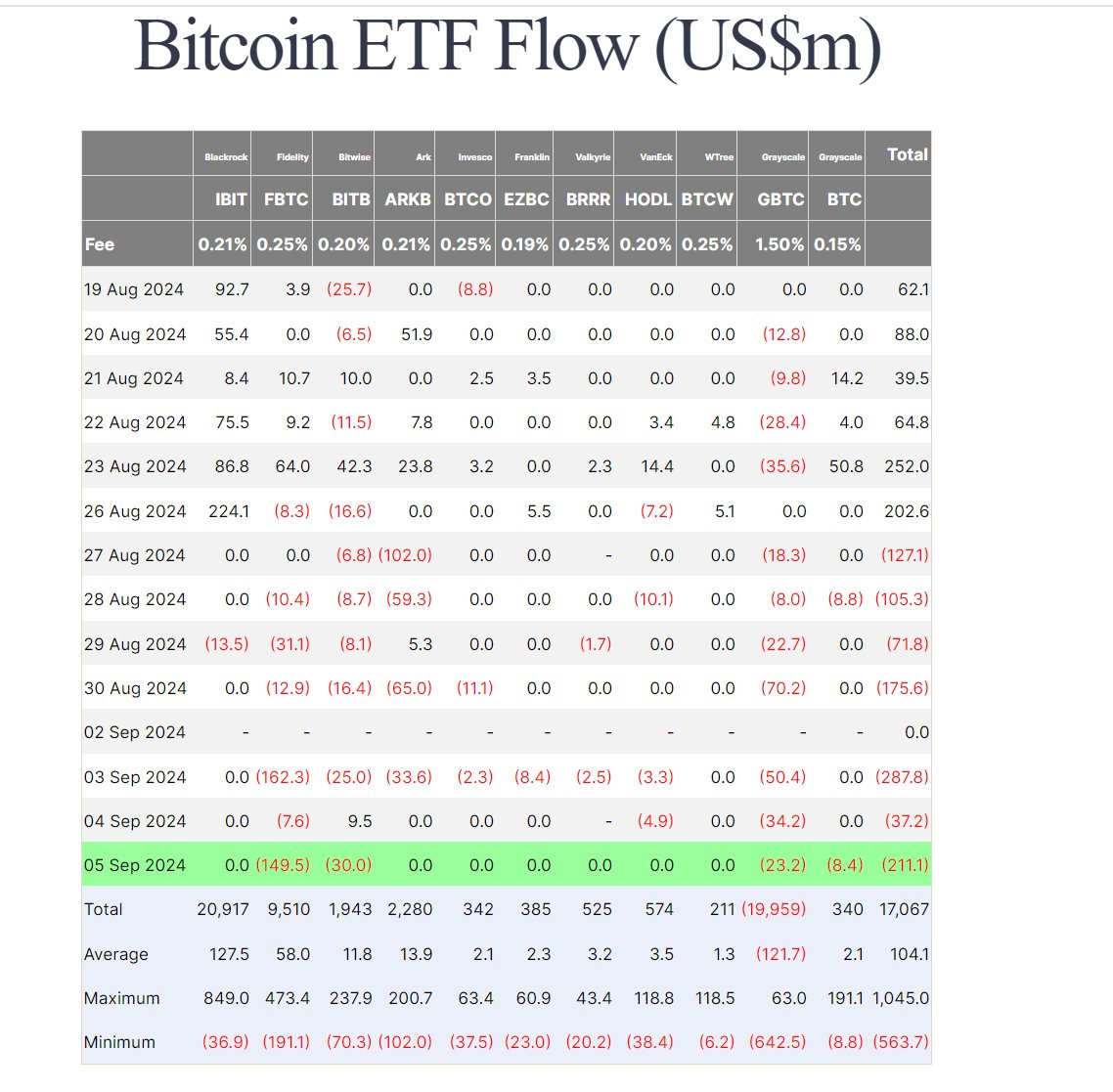

Aside from falling prices, ETF funds recently had their worst day in four months as they saw many outflows. Interestingly, Bitcoin outflows hit more than $1b in 7 days.

However, here are a few reasons for the market anomalies in September:

Market Sentiment and Investor Behavior Historically, September marks the end of summer in most parts of the world. Investors often reassess their portfolios and trading strategies during this period.

The summer months tend to have lower trading volumes as many market participants take vacations, leading to an overall slowdown. September brings them back, and it's not uncommon to see a correction in assets that have experienced low summer trading liquidity.

Tax Planning and Fiscal Cycles Another factor contributing to September's bearish sentiment is fiscal cycles, particularly in the U.S. Investors may be positioning themselves for end-of-quarter tax strategies, leading to selling pressure.

This selling can be compounded by the broader stock market's performance, which often experiences increased volatility in September.

Regulatory and Macroeconomic Events September is often a month of macroeconomic adjustments. Governments and regulatory bodies tend to announce new policies or adjust existing ones at this time.

This regulatory uncertainty, particularly in regions like the U.S. and the European Union, often creates market jitters, negatively affecting speculative assets like Bitcoin.

While past performance doesn't guarantee future results, historical trends are worth noting. September 2024 may see similar patterns, particularly if macroeconomic uncertainties, such as regulatory developments, persist.

That said, Bitcoin is known for its volatility, and a surprising breakout is always possible, but the market's usual cautiousness in September remains a factor to consider.

Not financial advice though but it should be viewed as an opportunity rather than a cause for panic. Long-term holders and investors often use this month to accumulate at lower prices, taking advantage of temporary dips.

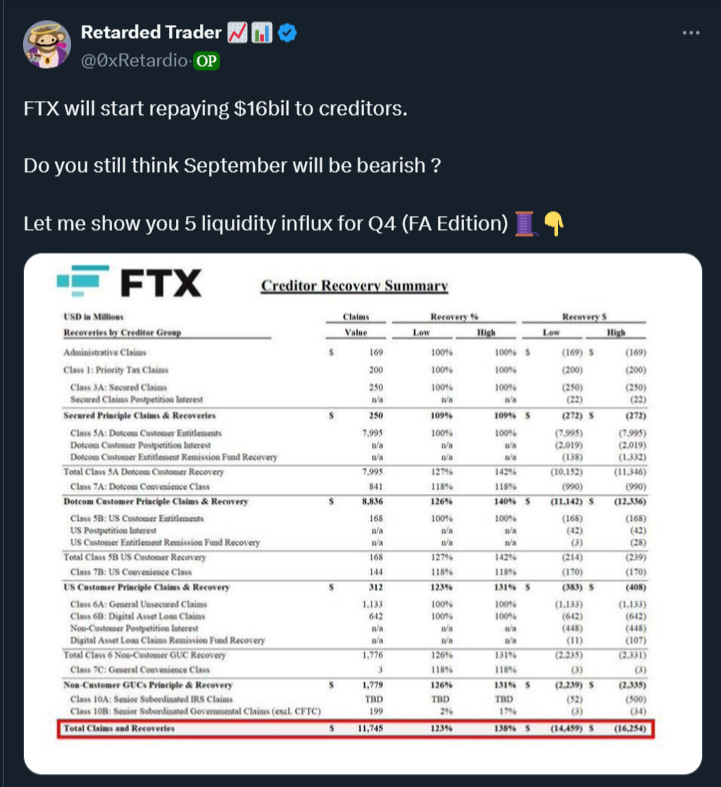

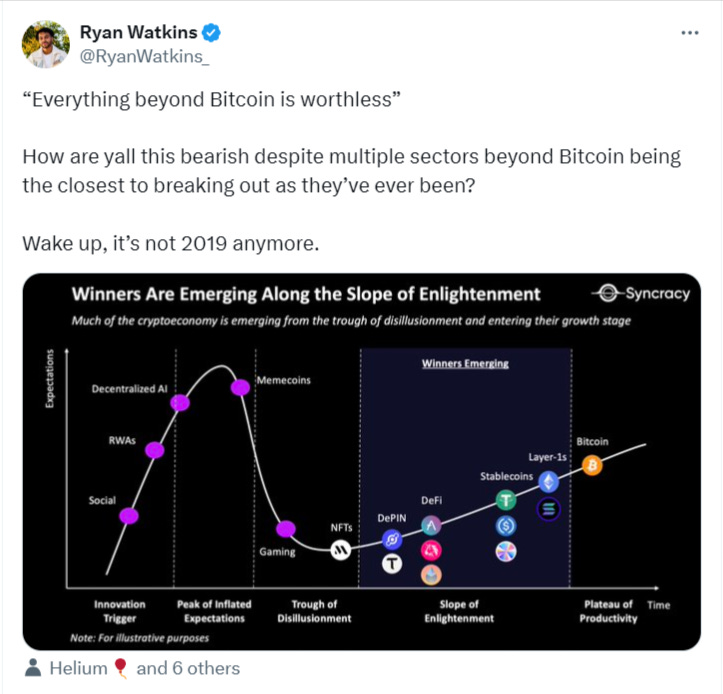

Besides, there are still some signs of late-September breakout following potential liquidity injection by a couple of factors. Some are captured in the attached thread:

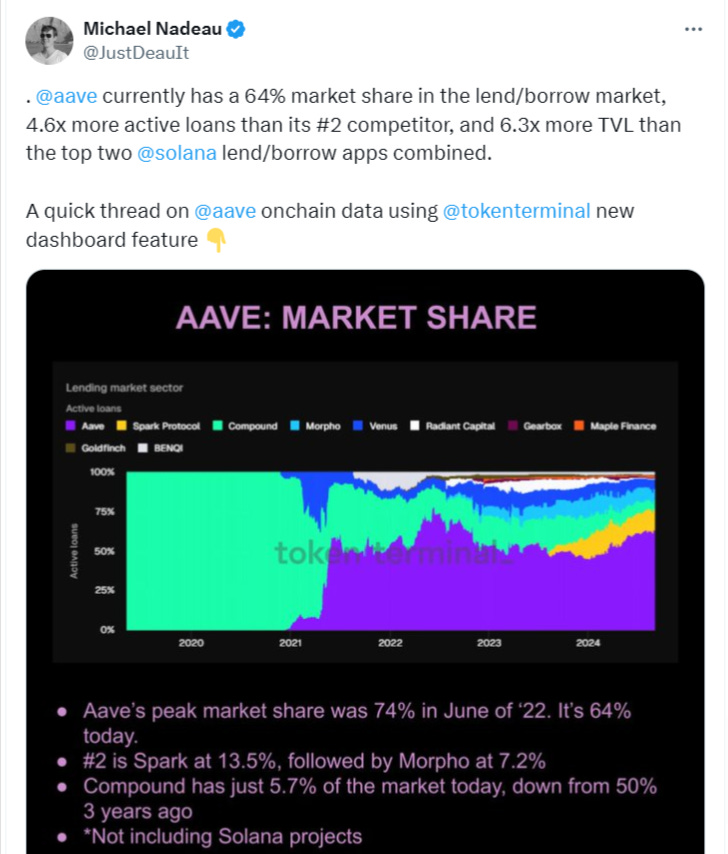

Alpha Bites and Tweets

That’s a wrap.

Thanks for reading!

Viktor DeFi.

PS: I’d love to hear your feedback and comments.