Asymetrix: The Rising LSDfi Star

An underrated gem!

Hey friend, today’s project research edition focuses on Asymetrix, a rising LSDfi Star. Enjoy the gems.

The fascination with winning remains a key component in the continuous fan loyalty to sporting events. The anticipation for that big moment creates and sustains the euphoria that keeps people glued to the game. This is not just true for sports but also true for Premium Bonds.

A case study that readily comes to mind is the British Premium Bonds, which currently boasts over 23 million people investing more than £120 billion in its bonds. Research shows that the success of British Premium Bonds boils down to two reasons: first, there’s no perceived threat of losing their capital, and second, the thrill of winning a lottery.

Bringing it together, ETH staking has grown in leaps and bounds in the last couple of months, attracting builders and users. But the thing is that the average APR of LSD is between 4-5% APR, and there is no fun in the staking process and rewards distribution. That’s where Asymetrix Protocol comes in.

“My team invented a protocol which allows you to earn several hundred percent APR on ETH staking, even with a small deposit. And a little bit of luck”. – Rostyslav Bortman, CTO of Asymetrix.

What is Asymetrix

Asymetrix is not your usual LSDfi project; it’s an innovative staking protocol with a dose of excitement and luck. It’s a decentralized, non-custodial protocol for asymmetric yield distribution generated from staking. Built on Ethereum, Asymetrix allows users to earn bumper yields on ETH staking.

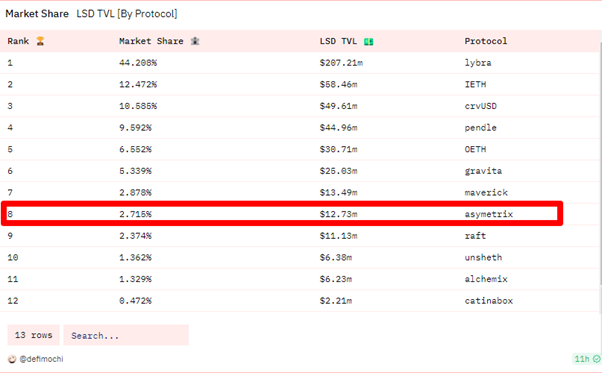

As mentioned earlier, the concept of Asymetrix was inspired by the success of Premium Bonds in the UK. That said, Asymetrix is leveraging a wildly successful traditional model to operate in Crypto - by encouraging users to stake their ETH for an opportunity to win life-changing rewards. Within a couple of months after launch, the project quickly became one of the leading LSDfi protocols by TVL - clearly showing its product-market fit and the efficacy of the bonding model.

Tech: How it works

You’ll probably be wondering how Asymetrix works and how to get involved. I’ll illustrate how it works with a practical example, followed by detailed steps and the tech behind it.

For instance, 200 users deposit one stETH in the Asymetrix protocol, totaling 200 stETH. After that, the pool generates ten stETH in staking rewards. Asymetrix will collect and distribute the ten stETH randomly to one user. The best part is that the lucky winners receive a whopping 500% staking reward, while the other 199 stakers receive 0% but keep their initial deposit.

Step 1: Deposit and Minting Procedure

The process starts with users depositing their stETH into the Asymetrix smart contract. In return, the protocol mints Pool Share Tokens (PST) in a 1:1 ratio to the user’s stETH deposit and sends it to their wallet. The minted PSTs acknowledge the user’s deposit, reflect their share in the pool, and are required for withdrawal. As of writing, the minimum deposit threshold in Asymetrix protocol is 0.1 stETH.

Step 3: Yield Distribution

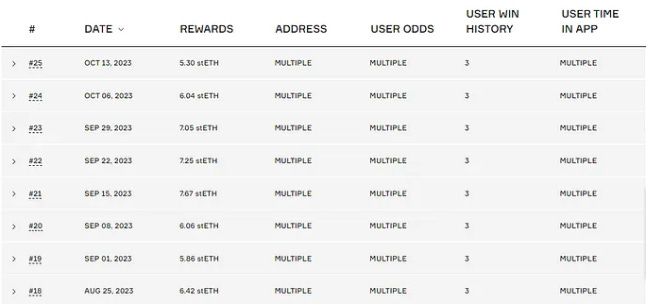

After accumulating the rewards from the staked stETH, Asymetrix distributes the yields to the winner(s). A random draw is conducted every 604,800 seconds, approximately once a week. After the draw, the algorithm will randomly pick and reward winners with the help of Chainlink VFR.

No one can influence the results of the draws, not even the DAO. Each user’s odds of winning are determined using the Time-Weighted Average Balance (TWAB) formula, which calculates the user’s contribution to the pool and time user’s deposit is kept between two draws. After that, Chainlink’s VRF generates random numbers and matches them with the picks to generate the winners.

Step 4: Winners

At the end of the draw, the winners automatically get their rewards in PST (equivalent to the amount of stETH won). This increases the user’s balance and chances of winning in future draws. Users enjoy the flexibility of withdrawing their tokens at any time, giving them complete control over their funds.

So far, Asymetrix has distributed 87.95 stETH earned in weekly draws to 28 lucky stakers in fourteen weeks. The transparency and fairness of the draw make it even more exciting to users looking to try something new. And unlike traditional staking, it allows stakers to earn a ‘supposedly’ annual APR in just a draw.

Tokenomics

ASX is the governance and utility token of Asymetrix. It has a total supply of one hundred million tokens, of which 50% is allocated to the community, 25% for investors, and 25% for core contributors. The team reserved 10% of the community’s 50% for incentivizing early protocol users. As of writing, 5,000,000 ASX has been distributed to users in the first distribution phase.

Hacken, a notable audit firm in crypto, has audited Asymetrix. Also, they are running an ongoing bug bounty program to help secure the platform while rewarding bounty hunters.

That's Not Even All…

Recently, the protocol announced the release of Asymetrix Version 2. The V1 was awesome, but the V2 has more features and a 360% improvement on the ASX token design. Here are three upcoming V2 functionalities that stand out:

esASX (Escrowed ASX Token)

As the name implies, esASX means escrowed ASX, which technically has the same value as the governance token - ASX. EsASX is a non-tradeable token built for long-term purposes and project sustainability. Users will need a 100-day vesting period to convert their esASX to ASX at a 1:1 ratio - as this will help reduce sell pressure and curb early dumps.

With the upcoming V2, esASX will be the default token for early user incentives and will be distributed in the next phase of the incentives distribution. Tokens allocated for early incentives in Phase 2 are divided into two parts. 1,000,000 esASX/ASX, will be distributed among all users with a deposit in Asymetrix, just as before. The second part, with 3,000,000 esASX/ASX, is designated for users who have a BOOST in the esASX/ASX distribution.

BOOST

Two novel boosting mechanisms come with Asymetrix’s V2: ODDS BOOST and esASX BOOST. Users acquire ODDS BOOST whenever they provide and lock liquidity on the Asymetrix smart contract, giving them more chances of winning rewards during the weekly draws. On the other hand, the esASX BOOST is an extra incentive given to liquidity providers to enhance the distribution of esASX tokens.

Mini Pools

Think of mini pools as support groups that enable smaller depositors to participate fully in the Asymetrix ecosystem. In reality, mini pools are a collective of users with small deposits that pool their funds to compete in the weekly draws. Also, the rewards earned are distributed to the participants according to their share in the pool.

In Conclusion

In the early days of decentralized finance, people came in mainly for the technology, to try a new internet financial system that is gaining popularity. But now, it’s primarily for better returns and the thrill of winning - which Asymetrix easily offers. Imagine receiving a bang yield of 500% (or even a quarter of that on the Mini Pool), the dopamine hits, and the goosebumps it brings.

And even if you didn’t win, you’ll get back your initial deposit and some esASX/ASX rewards. In the long run, this model will enjoy the same scaling effect as the British Premium Bonds. With the growth statistics and the upcoming V2, it’s only a matter of time before Asymetrix leads the LSDfi narrative.

Thanks for the explanation. Makes me think of PoolTogether https://pooltogether.com/fr.