2026. 5 Narratives and Verticals.

A year littered with opportunities.

Happy New Year, and welcome to the 94th edition of the Gems Corner.

We’re finally in 2026.

Expectations are high, predictions are bullish, markets are primed, and most importantly, you are here, ready to smash your goals. Each year comes with its sentiments, madness, and catalysts, and understanding this helps you win.

The world is re pricing risk, sovereignty, and truth all at once. Trust is becoming expensive and we’re entering an era of hard systems that defend, verify, settle, and sustain reality. And capital is also flowing in large numbers toward that direction.

Today, I’ll be focusing on five narratives and verticals. Not because they’re trendy but because evidently it is where the market is headed.

Let’s dig.

Prediction markets

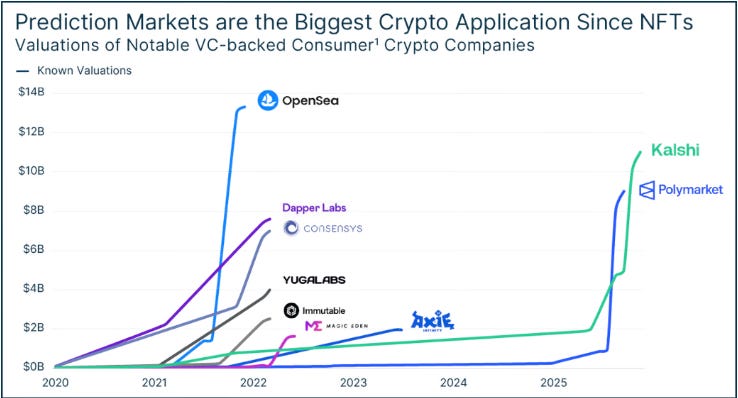

In 2025, we saw “truth” morph from a public good into a financial instrument. What ignited during the 2024 United States presidential elections as a tool for public consensus later turned into a multi billion dollar industry.

The thing is, prediction markets matter because they do something media can’t. They make participants put their money where their mouth is. That creates an incentive to gather information, correct errors, and converge on a probabilistic forecast.

Before, people used to turn to news media for real time updates on the happenings around the globe, but now they turn to prediction markets. Not just that, the leading prediction market platforms, Polymarket, Kalshi, and Opinion, are valued at about $20B in combined value.

My thesis is this: as AI slop litters the internet, retail and institutions will pay for signal. Prediction markets are gradually becoming the ‘truth layer’ for decision making, political forecasting, supply chain planning, even media itself.

If you’re not using prediction markets already, it’s time to start getting familiar with them. Who knows, you might hit a jackpot predicting the next global event.

a16z’s recent report states that, ‘Privacy will be the most important moat in crypto this year’, and I agree.

From the onset, the crypto industry has been about transparency and decentralisation. While on chain transparency is fantastic and has brought us here, the next era will be driven by privacy, not just in transactions but also in the infrastructures.

Especially with the advent of institutions, the demand for things like private stablecoins, transactions, and consumer apps is beginning to skyrocket. Also, with the rising attacks on traders, it becomes a brainer.

Monero and Zcash are dominating the privacy narrative, but I expect more innovative emerging players to run hard. Positioning is key!

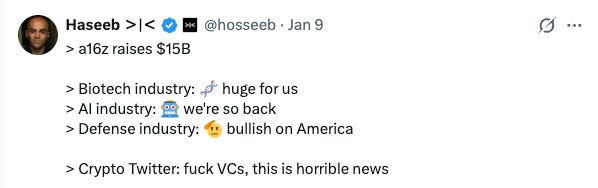

3. Institutional Era

For years, institutions didn’t touch crypto-related assets largely due to it’s highly-volatile nature and also stiff regulations. Then came Micheal Saylor’s Strategy success with its Digital Asset Treasury (DAT) - pushing MSTR’s price from $13 to $455, the proliferation of stablecoins, and relaxed regulations in the United States and other top countries.

DATs are companies that hold cryptocurrency and attempt to outperform the underlying asset through various strategies.

Now, every institutions wants exposure to crypto-assets, either through DATs, or ETFs, or even stablecoin adoption. Institutional participation is no longer optional, but a necessity.

The best part is that the institutions are not just coming alone, they’re bringing capital inflows as well. You’re still early, friends.

4. Defence Tech

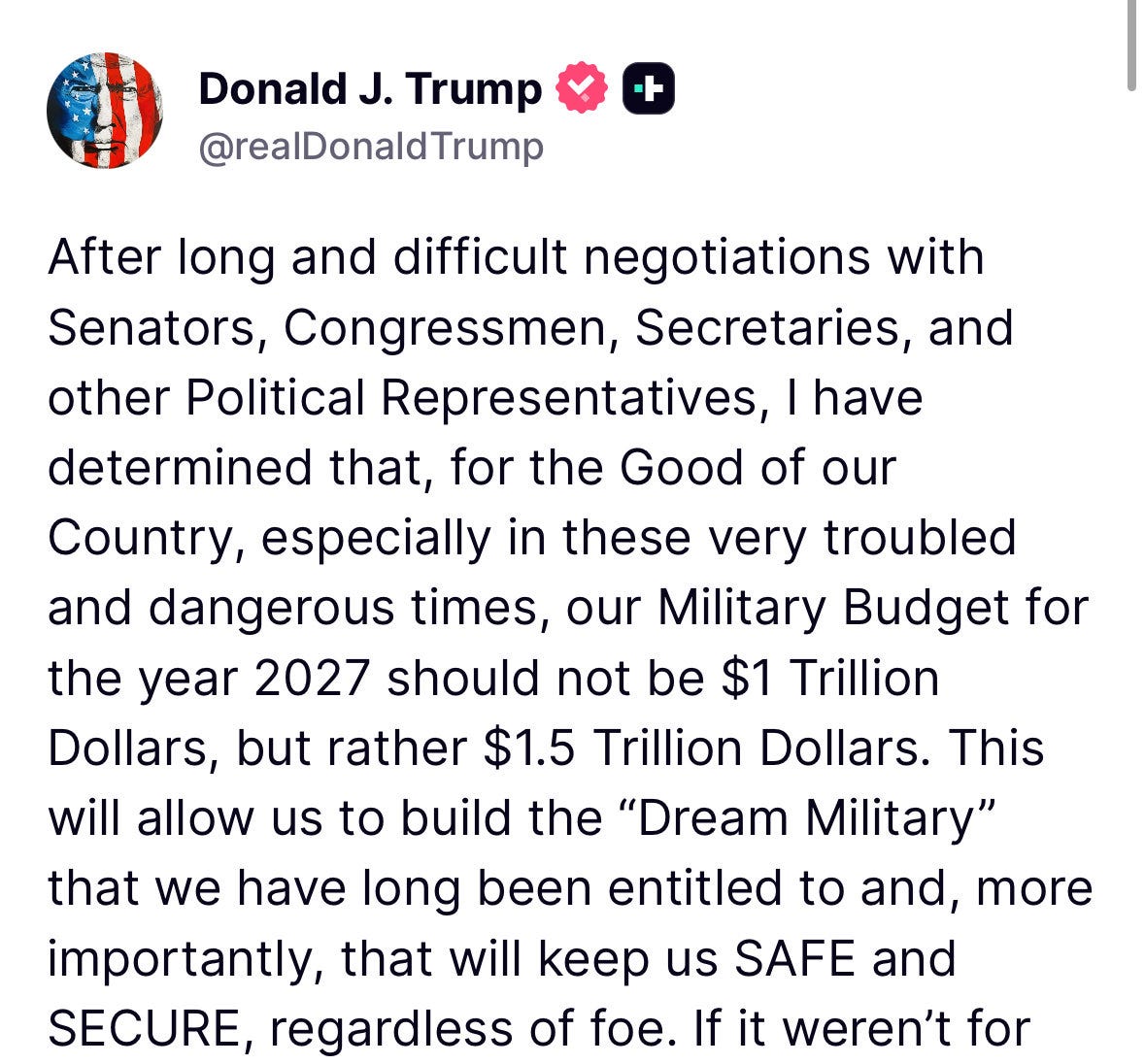

If you’ve been keeping abreast of the news, you’ll observe that there’s always a conflict between nations and world powers showing off their armory. The need to protect territories and show dominance is driving countries to spend billions and trillions annually on defense instruments.

These budgets are not just going into the acquisition of better jets and bigger warships, but into the development of new platforms powered by software, data, autonomy, and cyber resilience.

This is why defence is one of the few sectors where government budgets and private innovation are converging into real, long duration growth. Some high growth verticals of defence tech to explore at your convenience include additive manufacturing, artificial intelligence, robotics and autonomous systems, immersive technologies, cybersecurity, advanced military equipment, and the internet of military things.

Lastly, 2026 is a great time to gain exposure to defence tech stocks and crypto assets, don’t sleep on it.

5. Uranium

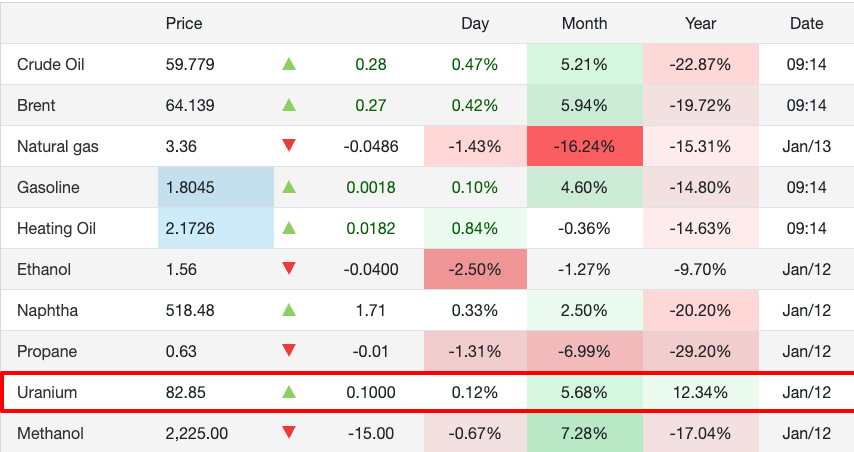

Truth is, Uranium hasn’t being a fancy option for investors over the past couple of years. But as the world changes and technology advances, this is changing.

Interestingly, 2025 saw a decent rise in the price of uranium ($74.56 to $81.55 per pound), primary due to the pressure on the supply sector to fuel a rising demand for nuclear power. It is set to increase even further because of the ever-increasing demand for AI and data centers.

According to the International Energy Agency (IEA), Global electricity demand could rise by 3,500 TWh in the next three years (equivalent to Japan’s annual use), with data center capacity doubling to 200 GW by 2030. On the back of this, Power demand from data centers could jump by 175% by 2030.

With this, 2026 is positioned to be a breakout year for uranium.

The easiest way to gain exposure is through via uranium tokenisation, which enables fractional ownership and on-chain utility. A couple of crypto projects are already doing this - you could look up Uranium.io and Uranium Digital on Solana.

Aside these five verticals, I still have health tech, robotics, and crypto consumer apps on my list.

If there’s a year, you need to look beyond your horizon, it’s this year. Opportunities will erupt from verticals you least expected. So, be flexible - entertain new ideas and explore new interests.

One thing is certain, 2026 promises to be transformative, with these verticals converging on DeFi to create new yield opportunities and tokenized economies. Whether through privacy-enhanced protocols or tokenized real-world assets, the focus is on sustainable, institutional-grade innovation.

Alpha Bites and Tweets

That’s a wrap.

Thanks for reading!

Viktor DeFi.

PS: I’d love to hear your feedback and comments.